By Mark Crawford, Contributing Editor

This article originally appeared in Orthopedic Design & Technology

Growth is strong in the cases and trays (C&T) orthopedic market, especially in the extremities sector. For example, the overall global procedure trays market size was valued at $17.6 billion in 2022 and expected to expand at a compound annual growth rate of 11.4% from 2023 to 2030. This growth is driven by the increasing number of surgeries, which will “continue to fuel the product demand in the near future,” states Grandview Research.1 Another key driver is increased investment in healthcare infrastructure and “the expansion of medical facilities, such as the rise in surgical centers, worldwide,” said Mike Phillips, president of Phillips Precision Medicraft, an Elmwood Park, N.J.-based manufacturer of custom medical instruments, implant cases, and trays. “These factors contribute to a higher demand for sterilization trays and their components.”

Hospitals accounted for over half of the combined global C&T sales in 2022, which reflects their wide variety of needs, including reducing the number of hospital-associated infections through the use of sterile supplies for surgeries and instruments that can be effectively sterilized. “Therefore, doctors and staff in operating rooms are highly dependent on using procedure trays,” stated Grandview Research. “The adoption of procedure trays helps reduce the incidence and operational costs.”

The C&T market remains dynamic with constant pricing and timeline pressures. In the rush to get to market, medical device manufacturers (MDMs) tend to overlook case and tray manufacturing, which comes at the final stage, once the instrument designs are frozen. “This puts additional pressure to improve timelines and ensure the synergy of the development teams,” said David Hollner, plant manager for the Rockaway, N.J.-based Intech Group which specializes in contract manufacturing of instruments, cutting tools, implants, silicone handles, cases, and caddies.

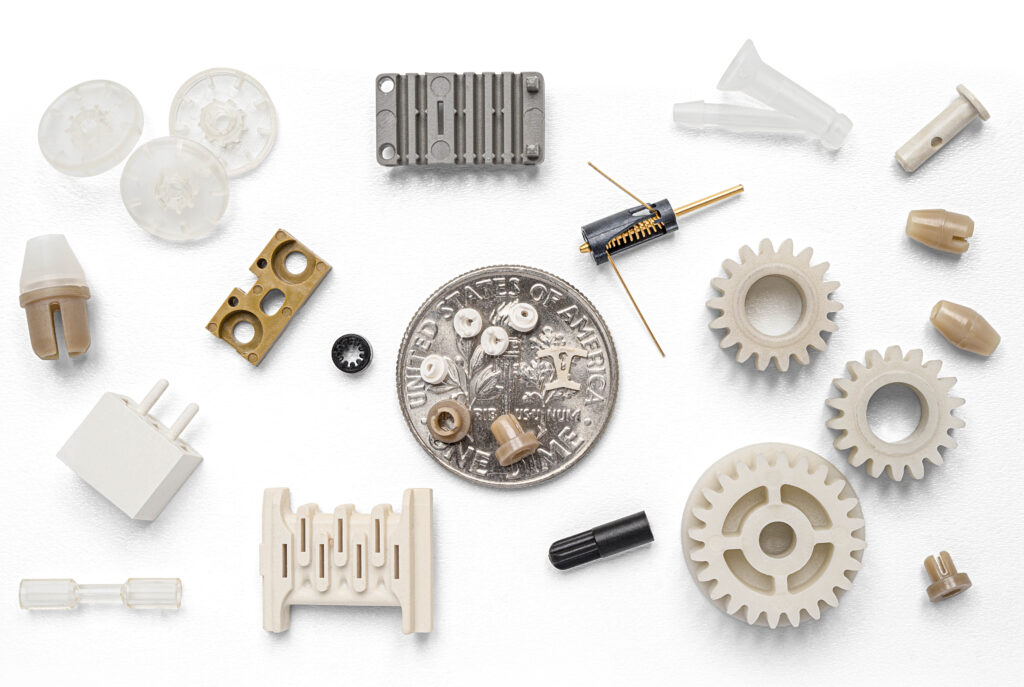

As critical as the C&T process is for delivering safe and undamaged products, too many MDMs wait until the end of the project to deal with cases and trays, which may result in unwanted delays. Implants and instruments are often fully designed and the project timeline nearly consumed, leaving little time for cases and trays to be developed. Although seemingly straightforward in concept, C&T sets often comprise more than 100 fabricated components, all of which are intensively designed and manufactured.

“A deep level of manufacturing expertise and understanding of the tools, instruments, and implants is critical to drive optimal solutions,” said Andrew Thomas, Ph.D., senior director of operations for Indianapolis, Ind.-based Viant Medical, a full-service medical device manufacturer. “Cases and trays cannot be overlooked as a key differentiator for OEMs that want their products to stand out against their competitors and meet evolving customer/patient needs.”

Another key role for C&T is aiding compliance with increasingly stringent regulations, such as the new unique device identification (UDI) requirements, which increase tracking and tracing obligations.

“These regulations necessitate digital systems and process changes to ensure full traceability throughout the device lifecycle,” said David Ryan, CEO for SMADE, a Lyon, France-based provider of digital tracking solutions for the orthopedic industry. “Implementing UDI requirements can be complex and costly, and is highly dependent on each company’s supply chain model. Additionally, OEMs must rigorously track and prove the efficacy of their devices, ensuring compliance with these stringent regulatory standards.”

Latest Trends

A growing number of orthopedic manufacturers are focused on modularity for their instrument sets. They want to maximize their inventory efficiency by only shipping or deploying what is needed for an individual surgery, rather than more comprehensive sets that come with a vast array of instrumentation that covers multiple possible surgeries. They are also tailoring their C&T delivery systems to very specific procedures and even individual physicians. By consolidating instrument sets and delivering fewer units to the field, considerable time, money, and inventory space are saved.

“There is a strong push towards modular solutions that are both OR-efficient and cost-effective,” Hollner confirmed. “Trauma and extremities are hot segments. MDMs want to receive a clearly defined set of instruments in line with market requirements integrated directly into their products. However, without a clear set definition from MDMs, it is very difficult for us to hit their requested target timelines. As a vertically-integrated partner, Intech strives toward best-in-class delivery for our customers, but it is truly a two-way street. Tight timeline requests demand that teams be dynamic, multi-focused, and collaborative.”

It is also important to select weights and footprints that ensure cases fit within sterile containers and in autoclaves at hospitals (something to discuss early in design for manufacturability). “Ambulatory surgical centers are increasingly popular and their smaller footprints require fewer trays and more modularity,” said Jeff Klein, engineering manager for Tecomet, a Wilmington, Mass.-based full-service designer and contract manufacturer to the orthopedics industry. “This way the surgical team only brings the absolutely essential, size-specific, instruments and implants into the operating room, reducing the amount of equipment that needs to be sterilized and stored.”

“C&T delivery systems also serve as shipping containers, so it is also important to collaborate with OEM partners to ensure case and tray contents are fully secured and protected during transit,” added Phillips.

Smart tracking technologies enhance C&T delivery by ensuring comprehensive traceability and accountability of surgical instruments and implants. The demand for advanced tracking systems continues to grow, driven by the need for enhanced regulatory compliance and meeting UDI requirements. Sometimes inventory management is also a problem. “Medical device storage is often disorganized, record-keeping is inaccurate, and over-ordering leads to unnecessary spending and excess inventory in the field,” said Ryan. “Gaining full visibility of the supply chain by localizing inventory and making better use of it is one of the biggest challenges to be faced.”

What OEMs Want

Top customer expectations in the case/tray segment are delivery speed, design collaboration, and responsiveness. Many MDMs seek smaller, more precise sets that are tailored toward specific surgeries. These sets take up smaller amounts of space overall, and require less labor to clean and sterilize.

Reducing the number of stock-keeping units [SKUs] has become a strategic initiative for many orthopedic manufacturers to enhance efficiency and reduce costs. By minimizing the number of SKUs, “healthcare providers can streamline operations, fitting more essential items into trays and cases while eliminating redundancies,” said Dr. Thomas. “SKU optimization aligns with value-based care models that emphasize cost savings and improved patient outcomes.”

MDMs and their design partners develop graphics with form, fit, and function in mind to help surgical staff easily identify the location, use, and relevancy of all components in the case. Eye-catching designs also help an OEM’s brand stand out in the operating room. “Achieving this requires a very talented engineering team on both ends of every project to deliver approved final design from concept to completion and testing, on time and on budget,” said Phillips.

Bold graphics and branding, deep image anodizing, and more sophisticated laser etching are all considered to be leading-edge processes. “Interior graphics are evolving in support of easier kitting, improved operational efficiency, and effective sterilization,” Dr. Thomas added.

Another key consideration in case and tray design is weight reduction. The challenge lies in maintaining C&T functionality, while still ensuring medical staff needs are met without the burden of excessive weight, which can impede mobility and accessibility during critical healthcare procedures. The industry’s response has been to innovate with lighter materials and smarter designs that do not compromise functionality, ergonomics, or the safety of medical instruments. Other factors that impact case and tray design are ease of use, size, balance, and organizing sterilization systems to match the surgical procedure sequence. Rapid prototyping is an essential tool for reducing timelines to verify instrument and implant placement within the case or tray. Once this is done, MDMs can reduce the time and risk of going into fully dressed verification and validation prototypes and then into full production.

Design for Manufacturability and More

Design for manufacturability (DFM) is crucial for ensuring cases and trays are produced efficiently and cost-effectively while maintaining high quality. It involves selecting appropriate materials, optimizing manufacturing processes, and ensuring the design is suitable for mass production.

Manufacturing methods continue to evolve for efficiency and quality—and always with speed to market in mind. Cases and trays must be engineered to ensure the safe, on-time transportation of instruments and implants while minimizing movement, vibration, and damage. Since all case/tray designs must be validated for sterilization, cleaning, and processing, sterilization details should be discussed early in DFM. This can be critical for determining whether or not a set will pass validation, particularly within a standard autoclave cycle—trays must be able to withstand repeated sterilization cycles without degrading.

The process of designing and manufacturing cases and trays is often complicated due to the combination of thousands of geometric considerations, customization, and the pressure to deliver quickly. “During the production process, hundreds, and sometimes thousands of individual parts must be produced on multiple paths, and they all have to come together for assembly within two months,” said Jim Spencer, CEO for Trifecta Medical, a Plainfield, Ind.-based designer and manufacturer of orthopedic instrument case/tray systems.

As in most manufacturing processes, there is always room for creative and innovative new ways to save time and money in the manufacturing process. Cases and trays are no exception—”each set can present its own unique challenges based on the instruments and implants that are contained and the customer’s surgical technique,” said Hollner. “For example, there are always challenges to reduce the number of brackets and to add modularity into those brackets whenever possible.”

Early design support ensures ease of manufacturing and limits the number of design iterations. “Collaboration in the pilot stages of case-and-tray design is crucial for achieving efficient, cost-effective, and high-quality outcomes,” said Dr. Thomas.

At first glance, case and tray designs may seem simple. After all, their main purpose is organizing and protecting medical instruments during transportation and medical procedures. However, achieving the delicate balance between simplicity and functionality is often considered an art. Designers must consider factors such as:

- Instrument compatibility—Ensure the case accommodates various instruments, from scalpels to forceps, without compromising their integrity

- Ergonomics—Designing trays that are easy to handle, minimizing strain on medical staff during critical moments

- Sterilization—Selecting materials that withstand rigorous sterilization processes without degradation

“So, while the basic concept remains constant, the devil lies in the details,” said Dr. Thomas. “In addition, each specialty—orthopedics, cardiology, neurosurgery—has unique requirements, demanding tailored C&T solutions.”

The strategic partnership that results from DFM is just as important for cases and trays as it is for the instruments they protect. DFM leads to fewer iterations and optimizes speed to market. One of the biggest goals of DFM for C&T is improved inventory management and reduced SKU complexity. Collaboration between design teams, manufacturers, and end users allows for a comprehensive understanding of the specific requirements for medical cases and trays—including ever-important timelines. “SKU optimization ensures that the right amount of inventory is maintained, striking a balance between cost reduction, customization, and quality of care,” said Dr. Thomas.

Tracking C&T Assets

Speed to market and ease of use can be huge differentiators among hospitals and ambulatory surgery centers. This is where the Internet of Things (IoT) and its applications especially come into play. For example, SMADE Hot Trackers technology optimizes visibility on medical device location and activity. These trackers can be embedded into any autoclavable asset to keep track of surgical trays, as well as non-autoclavable assets such as totes or containers—at all times—to show what is happening in the field, from the moment the cases and trays leave the warehouse to the time they arrive at their final destination.

SMADE Trackers embedded into cases and trays can withstand up to 500 sterilization cycles, temperatures up to 140°C, and pressures up to three bars, all while remaining perfectly sealed and maintaining high performance. “Our trackers are designed to maintain high performance and long battery life, even in the metallic surroundings of surgical kits, providing uninterrupted connectivity and data transmission,” said Ryan. “They function flawlessly in demanding environments, offering comprehensive traceability and accountability for surgical kits. This technology can also be leveraged to improve regulatory compliance, inventory management, and operational efficiency.”

Digital tracking systems enable MDMs, hospitals, and ASCs to know, at any time, the status of their cases and trays—whether they are in hospitals or distribution centers, misplaced or dormant, or counting loan cycles and in-field transfers. Real-time tracking capabilities help identify lost-in-transit assets, allowing for prompt action to recover them and prevent operational disruptions. Other benefits include:

- Non-operation days—Identifies non-operation days to understand periods of inactivity and take necessary steps to improve utilization

- Hospital visits and in-field transfers—Ensures cases and trays are always where they are needed most, improving overall efficiency

- Deliveries—Track deliveries in real-time, ensuring availability of surgical kits and reducing the risk of delays in surgical procedures

Intech’s Trackinbox system features autonomous, autoclavable Hot Trackers embedded into their cases and trays, which allow continuous monitoring and precise geolocation. “Our technology eliminates the need for manual tracking and ensures the reliability and availability of surgical tools,” said Hollner. “Furthermore, Trackinbox offers a subscription-free advantage, providing uninterrupted data for three years without hidden costs.”

Moving Forward

The overarching theme in healthcare today is improving efficiency and reducing costs, without sacrificing quality. Rising operational costs put significant pressure on hospital and ambulatory surgery center budgets. A key goal is figuring out new ways to utilize operating rooms to reduce costs. Staff can take a lean approach and analyze all inputs to the value stream to eliminate waste, consolidate workflow, and improve cost and time efficiencies. This also reduces unnecessary SKUs and can standardize multiple products to a single platform when possible.

Collaborations among MDMs and their contract manufacturers, who share the same vision of ongoing improvement and innovation, embrace technology to be at the forefront of change. For C&T, this means advanced IoT technologies such as automation and robotics, wireless, sensors, artificial intelligence, and machine learning. Technology will continue to lead the way toward new systems and advances in cases and trays, especially geolocation.

“The use of radiofrequency identification [RFID] technology for tracking C&T continues to expand as the technology advances,” said Phillips. “In fact, several of our OEMs are already working on the next-generation tracking technologies.”

Much of IoT’s transformative impact on healthcare is characterized by technological advancements that enhance economic efficiency and have positive social implications. This includes the development of smart healthcare systems that leverage IoT technologies for improved service delivery and patient care. Key areas of research include:

- IoT services and applications—Exploring how IoT can improve healthcare services and applications, with a focus on connectivity and data exchange between healthcare providers, patients, and medical devices

- Security and privacy—addressing the specific security and privacy requirements needed for IoT in healthcare, including the development of secure and privacy-preserving systems

- Emerging trends—Investigating the latest trends in IoT healthcare, such as the use of cloud computing, blockchain, big data, ambient intelligence, and RFID technology.

“These advancements in IoT for healthcare are paving the way for more efficient and effective medical case and tray designs, which can lead to better management of medical instruments and enhanced patient care,” said Dr. Thomas. “Research is ongoing and holds much promise for the future of healthcare technology.”

There is also a growing trend toward patient-centric technologies, which is driving the development of new devices that enhance communication and collaboration between patients and healthcare providers. In the context of cases and trays, this means designs can be more tailored to the specific needs of procedures, improving the overall patient and staff experience.

“The integration of wearables and sensors into patient monitoring systems is also influencing case and tray design,” said Dr. Thomas. “These technologies require storage and charging solutions that are now being incorporated into case designs, ensuring that all necessary equipment is available and ready for use.”

Through a commitment to DFM, orthopedic manufacturers can leverage the deep expertise and creativity within their supply chains to design new and impactful products, meeting ever-tightening timelines and still getting their products to market on time. This often involves discarding legacy thinking and embracing the collective expertise of their manufacturing partners who often have unique perspectives developed from working with other medtech companies, or even across different industries.

Phillips believes OEMs should trust their contract manufacturing partners to help them make the best possible product—and that the greatest design strength comes through collaboration. “An OEM’s input is necessary and always respected, of course,” said Phillips. “However, roadblocks can be encountered when a manufacturer is asked to reduce costs and find savings when the established thought process is already considered to be the gold standard.”

Phillips often hears clients say legacy systems engineered in the past cannot be revised due to outdated methods, or a lack of OEM resources. These systems, however, should be reviewed in light of upgraded or next-generation technologies, software, and equipment, as well as new manufacturing concepts developed along the way.

Last year, to demonstrate this point, Phillips personally re-engineered a system that was developed 12 years earlier for a favored customer. Contrary to what the customer expected, the re-engineered product resulted in a cost savings of $173 per piece. “When multiplied by the orders received over those 12 years, this re-engineering would have generated about $203,000 in savings on this system, which is still ordered annually,” said Phillips. “It’s important to keep in mind that the original design was approved 12 years ago and made with the best manufacturing tools available at that time. By working together with an experienced and innovative contract manufacturer, OEMs can often find unexpected ways to reduce costs and improve speed to market.”