By Sean Fenske, Editor-in-Chief

This article originally appeared in Medical Product Outsourcing

Outsourcing has become a pervasive aspect of the medical device manufacturing business for virtually every company within the industry, from startup through to the major players. This is in stark contrast to years ago when the practice wasn’t discussed (or admitted to) and many medtech firms were still attempting to keep certain tasks in-house. Fortunately, those days have been left behind as companies have found it more efficient to focus on core competencies and new development projects, electing to move some processes to service providers and legacy products to contract manufacturing organizations (CMOs).

The growth, in fact, has been significant, with the global medical device contract manufacturing market valued at $63 billion in 2016, according to ReportLinker. Further, indications point to continued, aggressive growth within the sector. Visiongain forecasts the market to increase to $102.9 billion in 2021 and $177 billion in 2027 (a robust 9.8 percent CAGR between 2016 and 2027).

With the growth, however, comes an array of challenges for both the OEMs and their service provider partners. One of the primary pushes in healthcare today is cost containment. That squeeze felt by hospital staff and private practice physicians alike is extended to their technology providers. These healthcare professionals are demanding devices that enable them to do more at a lower price. They will no longer accept incremental innovation as a reason to invest in a new product. At the same time, a new launch must have a reimbursement strategy for the buyer already established or adoption of that technology is extremely unlikely to happen.

“Continued increases in the cost of healthcare are driving stakeholder interest in reimbursement. Investors want to know up front whether there is coverage, coding, and payment before they risk investing in new technologies,” said Tom Hughes, health economics and reimbursement senior principal advisor at the Regulatory and Clinical Research Institute, a Minneapolis, Minn.-based medical device consulting and clinical research organization in an article posted on the firm’s website. “Payers increasingly expect new technologies to demonstrate better outcomes at equal or lower costs before they pay for them. More hospitals are establishing value analysis committees to evaluate all new products prior to entering a hospital or clinic setting. Physicians are interested in products that help them meet quality metrics imposed by government and private payers. And perhaps, most importantly, patients are becoming more educated and prefer interventions that improve quality of life at the lowest cost possible.”

This trend is compounded by the ever-changing landscape of both the medical device manufacturers and their outsourcing service partners through the M&A activity that has become so prominent within the space. The acquisitions and divestitures on both ends of the supply chain result in established relationships becoming severed while other firms struggle to remain on a preferred vendor list. [Editor’s note: Read more on this dynamic specifically in two features within this issue starting on page 82.]

With this in mind, Medical Product Outsourcing reached out to a number of full-service contract manufacturing organizations to hear directly from them about how they are addressing many of these challenges and transitioning to become true partners rather than transactional suppliers. Responding to the questions in this feature are:

Scott Christensen is the president and CEO of Bentec Medical, a completely integrated supplier of silicone-based, custom manufactured components and medical devices. With its U.S. headquarters in Woodland, Calif., the company was acquired in 2017 by private equity investors Hermitage Equity Partners and Greyrock Capital Group.

Joe Dziedzic is the president and CEO at Integer, a global provider of design and development services for medical devices and power solutions for the medical and non-medical industries. The company’s global corporate headquarters is located in Frisco, Texas.

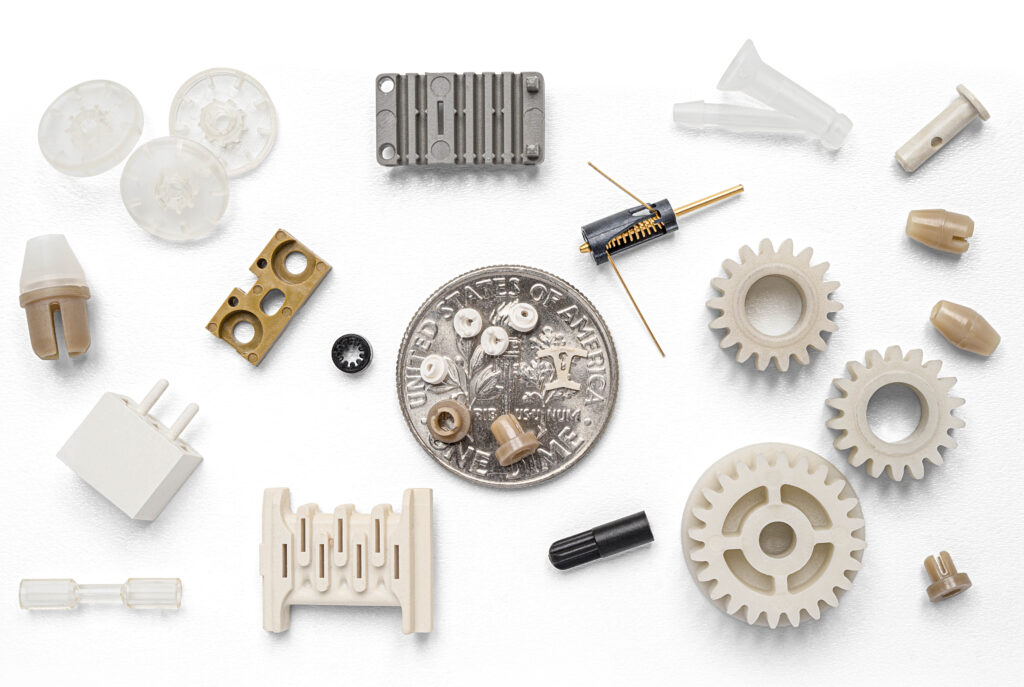

Bill Flaherty is the chief commercial officer at Viant, a fully integrated supplier for single-use medical devices. The firm provides everything from molded components to full manufacturing and assembly services.

Steven Ragaller is vice president and chief financial officer of Elk River, Minn.-based Cretex Medical. The family of companies specializes in providing a broad range of manufacturing solutions to medical device OEMs.

Billoo Rataul is the CEO of Paramit Corporation, a Morgan Hill, Calif.-based, FDA-registered manufacturer of complex, finished medical devices and instruments. The firm leverages its 30 years of experience in design, engineering, and manufacturing of medical technology and life science instrumentation for its customers.

Robert Rhoads is the executive vice president at Precision Medical Products, a company that offers its customers 50 years of experience manufacturing medical devices and almost 100 years of experience engineering and producing needles and other precision-crafted metal products. The firm is located in Denver, Pa.

Brian Semcer is the president of Somerset, N.J.-based MICRO, a third generation, family owned business providing contract manufacturing services from concept to commercialization. Capabilities include design for manufacturing, prototyping, component manufacturing, assembly, packaging, and inventory management.

Corey Smigelski is the general manager of Goddard Inc., a Beverly, Mass.-based engineering and design services firm. The company’s engineers offer a unique blend of mechanical design expertise while also offering an in-depth knowledge of the regulatory landscape.

Louis Weijers is VP sales & marketing North America for Q Medical Devices—Q Holding Company, headquartered in Solon, Ohio. Q Holding Company serves clients in a wide variety of global industries and markets, including medical-surgical and drug delivery, with a focus on quality and performance.

Sean Fenske: How would you describe the relationship between the OEM (the brand name device manufacturer) and CMO (contract manufacturing organization) in the medtech industry today and how has this dynamic changed from just a few years ago?

Scott Christensen: Today, the OEM/CMO relationship starts earlier in the product development cycle and is more collaborative than transactional in many cases. In the past, many OEMs wanted to move their product production to CMOs and then buy the majority of their products rather than making them. More recently, OEMs are starting their product development with the CMO at the component level then moving the completed developed product back in-house for long term manufacturing. OEM target profit margins are a key driver determining which strategy an OEM employs for its entire business or for selected product lines.

Joe Dziedzic: The relationship between the OEM and CMO is continuously evolving in today’s dynamic world of company consolidations and regulatory changes. OEMs expect more from CMOs as they are faced with pressures from an industry that expects more. In addition to the standard outcomes, like quality and time-to-market delivery, today’s CMOs must deliver process improvements, eliminate risk from the supply chain, and accelerate innovation.

Bill Flaherty: The broader trend is consolidation among medical technology OEMs. With all that acquisition activity, you get some really complex supply chains. So, OEMs are looking to simplify their supply chains with fewer, stronger suppliers they can rely on. Another side to this consolidation is that OEMs often face aggressive cost targets and the need to justify an acquisition. Or, OEMs may be distracted while they work to integrate their acquisitions. For all these reasons, OEMs are looking for a supplier to step up with fresh, new ideas and techniques to help them achieve their goals. For example, our engineering group looks at every stage of the development process to find innovative ways to optimize the production process, whether it’s tweaking the product design or changing the layout of a manufacturing line to boost efficiency.

Steven Ragaller: OEMs are adapting their business models as the healthcare environment evolves. Consumers are seeing more costs shift their way and fee-for-service models are being replaced by value-based care. OEMs are under growing pricing pressure and responding by remaking themselves into higher-value solution providers instead of simply device manufacturers. Increasingly, they want CMOs to be strategic partners. By outsourcing manufacturing and supply management, the OEMs can concentrate on product and service development, marketing, and clinical sales. That’s how they maximize value creation.

Billoo Rataul: Medical technology companies are beginning to realize that CMOs are fully capable of building even their most complex assemblies, so they are now more open to outsourcing finished devices.

Corey Smigelski: We have seen a growing need from major OEMs to utilize CMOs. Product lifecycles for many medical device segments are decreasing. CMOs provide a new level of flexibility and reduce the capital equipment burden for OEMs.

Louis Weijers: Depends on each OEM. Most OEMs seemed more focused on outsourcing compared to five years ago. OEMs expect more turnkey services from the CMs such as regulatory filing support, R&D customizations, and other services that have predominately been part of the OEM support structure.

Fenske: What factors are driving OEMs to seek out the use of CMOs more today than in the past?

Christensen: Cost is a driving factor that pushes companies to buy versus make. Bentec Medical is the labor force of many of our customers. We provide component engineering and manufacturing to turnkey solutions, delivering packaged, labeled, and sterilized products ready for the surgical suite or over-the-counter sales. OEMs today do not want to spend money on facilities, people, and systems. They need to spend it on research and development and bringing their products through a grueling regulatory review process, not spending it on a brick and mortar approach to grow a business.

Dziedzic: The economic landscape of the healthcare industry has forced OEMs to revisit their outsourcing strategies. Speed to market, reduced development and manufacturing cost, increased focus on core competencies (e.g., R&D, distribution), and access to supplier-based innovation are the main reasons OEMs seek out CMOs.

Ragaller: OEMs are under pressure to get new products to market faster. Product development costs are rising and device technology and materials are increasing in complexity. Manufacturing is capital intensive and, for many OEMs, is not a core competence. They recognize that CMOs can bring high quality, efficient manufacturing, and supply chain services. CMOs who are focused on the medical market understand the unique demands of the industry and bring robust quality systems and experience in FDA validation—keys to mitigating the OEM’s risk.

Rataul: OEMs are reaching the same conclusion that the hi-tech sector did in the late ‘80s and early ‘90s: It’s more advantageous to focus on your core competency, rather than try to do everything well. As you might imagine, startups are more likely to take this new approach than large, established companies.

Brian Semcer: We believe that many of the larger OEMs have recognized that their efforts are best applied to value-added areas in which they excel, such as device design and marketing, while outsourcing other core needs, such as manufacturing, packaging, and sterilization to CMOs. Small- to medium-tier OEMs can use the expertise of CMOs to augment or even substitute for their own internal capabilities. In this case, a skilled and qualified CMO may help them realize timely results and cost efficiencies they may not have been capable of themselves.

Smigelski: Many OEMs want to avoid major capital costs associated with setting up specialized manufacturing capabilities. Utilizing CMOs allows for shorter product lifecycles and the versatility to bring new and innovative products to market. OEMs are able to avoid being burdened with manufacturing equipment that doesn’t meet the needs of new products. The freedom to utilize the appropriate manufacturing process for all products yields more robust and effective devices.

Weijers: Primarily, the drivers for increased outsourcing are cost pressures, internal bureaucracy, and less investment in “bricks and mortar” operations by the OEMs.

Fenske: What types of tasks or projects are OEMs employing CMOs to accomplish today that weren’t being outsourced in the past?

Ragaller: More OEMs are pushing on both ends of the traditional value chain. On the front end, they are looking for engineering support, which can hasten development and commercialization of new products. On the back end, they want suppliers who are experts in and can provide outsource services for cleanroom device and kit assembly, packaging design, sterilization management, and order fulfillment. OEMs are moving from a transactional relationship with vendors who provide short-term, overflow discreet services, to long-term strategic partnerships with CMOs who bring a broad portfolio of capabilities, have expertise around therapeutic categories, and can scale to support their growth. They want to simplify their supply chain.

Rataul: The list actually runs the entire gamut of the entire product realization process from design through delivery. Startup OEMs in the life sciences are more likely to focus on the core science and outsource design and manufacturing of instruments and consumables, while large, established OEMs may choose to outsource only some of the design and manufacturing.

Rhoads: We seem to be much more involved in facilitating the design and development of products. Not just for design for manufacturability, but helping the customer through the initial design and performance feasibility testing stages of the product.

Smigelski: CMOs are becoming more involved in the engineering development of products. In some cases, this is valuable but in other cases, it has proven detrimental to the product.

Weijers: OEMs look for more technology advancements with CMOs. OEMs were more technology driven five years ago.

Fenske: What criteria should an OEM use to determine what aspects of product development and manufacture should be outsourced? In other words, how does an OEM determine what to “make vs. buy”?

Christensen: For the OEMs seeking Bentec Medical as a CMO, key factors include our long-term expertise in silicone fabrication across a range of processes from molding to sheeting to extrusion, our demonstrated ability to provide quality cost-effective silicone components to recognized leading medical OEMs in various markets, and our flexible manufacturing approach to both small and large production projects. Key here is that many companies may have expertise in plastics but lack the necessary experience dealing with silicone.

Ragaller: OEMs need to understand where they create the most value. Everyone has finite resources, and knowing where to allocate capital is critical to the success of any business. OEMs can leverage CMOs to get products to market faster and accelerate time to revenue.

Rataul: OEMs should simply ask themselves what is it they want to do better than anyone else in the world. Anything beyond that should be outsourced to CMOs who are the best in the world at doing what they do.

Rhoads: Every OEM seems to have their own method of evaluating this but it boils down to capacity and capability. If the OEM doesn’t have laser capabilities or injection molding in-house, they’re likely going to outsource these functions. If technology isn’t the driver, it often comes down to their facilities. If they have space and an available workforce, they may want to bring things in house to cover the facility costs until they fill up and need to either outsource or build a bigger building.

Smigelski: There is certainly a cost component to this decision but additionally, the complexity of the manufacturing process is a key factor. Products that are high-volume commodity products with a long-term production need are best suited to OEM manufacturing. In some cases, medium complexity, shorter run devices are better suited to the CMO’s capabilities. There is not a definitive answer to what products are better suited to OEM versus CMO manufacturing.

Weijers: In my opinion, it’s all about “fit” and core competence. The CMO has to be able to deliver. It is less risky for an OEM to source with a CMO that “owns” the core competence.

Fenske: How is creativity and innovation in device development enhanced through the use of a CMO?

Christensen: In dealing with a range of different customers, CMOs are called upon to help solve a wide variety of challenging technical problems. This broad base of experiences provides CMOs with an extensive pool of knowledge to tap into when an OEM brings them a new product development or production problem that needs a solution. A CMO’s extensive and varied knowledge also provides the expertise needed to support innovation for unique product manufacturing challenges.

Dziedzic: CMOs help OEMs solve the toughest medtech challenges faster to meet the demands of our fast-paced, open innovation, digital age. Leading CMOs have highly skilled teams of engineers and creative thinkers with a keen understanding of the markets they serve. These experts see problems as challenges and the impossible as new possibilities. In truly effective partnerships, the CMO becomes an extension of the OEM’s R&D team. Some CMOs also proactively invest in enabling technologies that can be leveraged by OEMs across multiple markets and product areas.

Rataul: A CMO can offer a fresh perspective when it comes to solving technically complex problems. While an OEM’s typical mode of operation might be to simply sustain or make minor modifications to an existing product line, a CMO looking at a situation with a new set of experienced eyes can often propose a novel set of ideas to elevate the quality and performance of a customer’s product(s).

Rhoads: OEMs are able to leverage our entire engineering group and all of their vast experiences. We’ve been able to conceptualize parts and put together conceptual prototypes within days that enable the customer to hold and study parts to get their ideas moving and see things that are possible they never imagined until they actually saw it.

Semcer: CMOs often distinguish themselves through subject matter expertise and specific manufacturing proficiencies that may not be available within OEMs. This can be brought to bear in the development phase when the CMO’s talent and experience provide the ability to rapidly prototype and prove out design in a more timely and efficient manner than may have been otherwise possible. A CMO’s expertise is particularly useful when applied to design for manufacturability. A CMO can really add value when they partner with an OEM to take a design from an initial concept to a robust, repeatable production process. CMOs also tend to be more in touch with next-generation technologies in their areas of expertise and can be key in bringing these advancements to the attention of an OEM.

Smigelski: In most cases, CMO development can help support product innovation because the OEM design teams are allowed to focus more on product development and less on process. The one risk is allowing most CMOs to take over the product development process prior to the core technology being finalized; this can lead to negative product outcomes.

Weijers: Speed to market! Less investment for the OEM. Good CMOs have validated processes (i.e., existing packaging and sterility validations) and biocompatibility data available that can shorten the time to market cycle.

Fenske: In terms of time to market, how can working with a CMO improve upon a project’s schedule?

Dziedzic: CMOs can enable novel and reliable approaches faster, ensure predictable product launches and ramp ups, and help resolve unforeseen issues to expedite time to market. For example, Integer was able to shave 15 months off the base timeline for a first-to-market articulating vessel sealer for a leading OEM. We applied our materials and end-effector expertise to design a successful flex joint—a key feature that was high risk in the timeline. Using lean methodology, while running parallel design and development processes, enabled the OEM to launch the product ahead of schedule. This is a particularly poignant example as the first use of the device was on a woman who was 18-weeks pregnant. The successful procedure helped save her life as well as that of her unborn child. If the product had not been available at this time, there’s a possibility the ending would not have been as good.

Flaherty: CMOs can help improve time to market by giving customers added bandwidth and additional horsepower to get through the product development process faster. In many cases, a CMO brings specialized expertise that an OEM may not have, especially an early-stage company. Partnering with a CMO to leverage a particular competency is much more efficient for an OEM than developing that expertise themselves.

Another way CMOs bring value is by deploying processes and systems that have been refined and validated over years of experience. For example, Viant’s Program Management group—all certified project management professionals—is highly trained to drive execution of each program to achieve cost targets and timelines. We have a similar dedicated organization tasked with managing and monitoring our supply chain to ensure we have materials to meet our customers’ needs, when and where they’re needed. Combining the right expertise with proven systems can smooth the process and accelerate the product development schedule.

Rataul: CMOs have many tools at their disposal to help accelerate a product’s time to market. First and foremost, a CMO can tap into its past experiences and systematize best practices.

Unlike an OEM that might launch a new product once every few years, a single CMO development team, as a matter of routine, releases many products in any given year. Likewise, while an OEM team might find itself distracted by having to juggle multiple tasks, a dedicated CMO development team can focus 100 percent of its energies on new product introductions. Additionally, a CMO that offers a full suite of services from design through finished product can ease the transition from one phase of development to the next, often overlapping tasks to maximize efficiencies and creating a seemingly “transfer-less” workflow. Finally, CMOs have the built-in flexibility to scale resources and other elements of the supply chain quickly and effectively, as product requirements evolve.

Rhoads: If the CMO already has experience and resources available, the OEM isn’t wasting time reinventing processes and assigning competing resources.

Semcer: In many cases, a CMO is smaller than the OEM, which allows the organization to communicate well internally and be nimbler then the OEM itself. Allowing a single CMO to manage the majority of the supply chain of a given device or project also results in efficiencies and time savings versus an OEM managing a disparate and far-flung supply chain themselves. In essence, CMOs can help OEMs to achieve more efficient turnaround due to streamlined project and supply chain management.

Smigelski: Having a turnkey manufacturing team can significantly accelerate a product’s time to market; having the resources and experience from an outside manufacturing team generally saves time on aggressive schedules.

Fenske: How are CMOs helping to ensure more efficient/faster FDA reviews of a medical device project in which they are involved?

Christensen: Experienced CMOs can provide exceptional project management based on knowledge of previous FDA product reviews/feedback; they will know what tasks can be done in parallel and what tasks must be done in succession. They can also provide feedback on schedules and assist in managing expectations—both key to success with FDA and CE mark preparation and review submissions. At Bentec, we understand these regulatory needs first-hand due to the branded medical devices we sell into the global marketplace.

Rataul: In an FDA submission, it is crucial to avoid gaps in the Design History File. Since a CMO is a contracted entity with clear and measurable deliverables, ongoing assessments are typically routine, objective, and transparent. A CMO, by nature of its contract, has a vested interest in demonstrating compliance with all product requirements and meeting all agreed-upon milestones, on time and on budget.

Rhoads: We find that we add values to smaller or less experienced OEMs due to our experience in this area, especially when working with products that are similar to other products we’ve worked on. We also have experience in packaging and sterilization, which are often overlooked in the design stage for the parts.

Smigelski: The assistance provided in this area is limited. If the CMO has established a regulatory pathway and currently manufactures predicate products, they can provide an expedited regulatory process.

Weijers: When CMOs own their own 510(k)s and can provide the predicate device for subsequent filings.

Fenske: What other significant advantages are realized by an OEM when working with a CMO?

Christensen: A major advantage is the ability to tap into the breadth of experiences that a CMO has acquired over time. The CMO does so many different things and over the years, builds a deep pool of knowledge and experience that can be accessed when needed. As a CMO, we learn from one project and can apply the knowledge to other projects and our experience grows even further while OEMs are focused on their own processes. We like to get involved as early as possible on new projects to provide that technical collaboration.

Dziedzic: CMOs can improve an OEM’s cash flow by optimizing development and manufacturing investment, and reducing supply risk through dual sourcing. Given the recent impact of hurricanes and fires to several of our industry’s OEMs, this is definitely top-of-mind. Other significant advantages of selecting the right CMO include rapid product scale-up capabilities and capacity, quality and regulatory resources, critical components/sub-assemblies, and manufacturing transfers.

Ragaller: In working with the right CMOs, the OEM gains access to world-class manufacturing technologies and expertise. They can off-load problems to a partner who deals with those same kinds of challenges every day. The OEM doesn’t have to invest in the equipment, talent, or business and quality processes necessary to get their product produced and into the hands of their customers.

Rataul: Many OEMs find there is a significant financial advantage to working with CMOs. Overhead or fixed costs, such as building space and personnel, become variable costs, affording OEMs a great deal more agility and flexibility. Working capital investments tied to inventory are no longer required, and cash flow is improved as a result of being able to negotiate 60- to 90-day payment terms.

Semcer: A significant advantage to OEMs partnering with CMOs is risk mitigation. Rather than an OEM managing numerous individual vendors, a full-service CMO allows an OEM a single point of contact and accountability. This eliminates the conflicts, delays, and “finger pointing” which often occur in a complex and multi-tiered supply chain. In addition, OEMs can access the intellect, technology, and management skills of the CMO without investing in any of the fixed costs associated with actual integration. Importantly, this valuable “outside asset” can be turned on and off by the OEM as demand for them varies.

Weijers: Using CMOs allows the OEM to focus on their sales model and further technology advancements.

Fenske: What recommendations do you have for OEMs seeking new CMO suppliers? What selection criteria should they consider most important?

Dziedzic: There are many factors to consider when seeking a new CMO, including:

- Quality performance is most critical. The CMO should be ISO 13485 and have a single quality program—including electronic data systems and processes—to ensure consistency across the company and minimize risk.

- Understand their capabilities. CMOs that support the entire product lifecycle from components to full devices and are vertically integrated can accelerate project timelines and remove supply chain risk. A keen understanding of regulatory issues can also help prevent hurdles.

- Make sure the CMO’s strategy and values are compatible with those of your company, including R&D investment, reputation for reliability, and culture.

- Visit the manufacturing sites that will be involved in your product’s development to ensure their manufacturing standards—technology, processes, cleanliness, etc.—meet your expectations.

- Get to know the team. Open communication and trust are key to a successful partnership. The CMO’s focus should be on understanding your strategy and delivering value-enhancing solutions that address your most critical needs.

Flaherty: First, OEMs should look for size and scale. With the consolidation we’ve seen in the industry, OEMs are looking to simplify their supply chains. Partnering with fewer suppliers with broad capabilities and deep expertise can save time, cost, and hassle.

Second, OEMs should look for agility. They want a partner that can get things done without a lot of bureaucracy. Early-stage companies lean very heavily on CMOs because of expertise they simply don’t have in-house. Agility and speed is just as important for established OEMs because they’re competing with nimble startups.

Third, OEMs should consider customer centricity. What our customers tell me is that they’re looking for the size and scale of a full-service CMO with a strong quality management system and operational excellence. But they also want small-company attention where they won’t get lost. They want responsiveness and connectivity with the management team. They want to partner with folks who act as an extension of their own organization.

Ragaller: In choosing CMO partners, an OEM will undoubtedly consider things like technical capability, quality systems and metrics, and price. But the OEM’s due diligence should also include questions like:

- Is the CMO committed to the medtech industry? Or is it just another market they serve? Are they experts in the industry’s unique requirements?

- What is the CMO ownership’s goals? Are they in it for the long haul? Or do they have a near- to medium-term exit strategy?

- Does the CMO have the ability and appetite to scale their business to support the OEM’s growth? Are they investing in innovative technologies and capabilities?

- Has the CMO embraced lean production principles? Where are they on their lean journey?

Rataul: Bringing a product to market in a cost-effective manner is the obvious end goal; however, OEMs often make the mistake of focusing only on a CMO’s quoted cost, as opposed to taking the time to calculate the “total” cost. Defects and missed deadlines can have a significant negative impact on the bottom line, and the best way to avoid these pitfalls is to broaden the CMO selection criteria to include other factors, such as depth of experience, design and manufacturing capabilities, and company culture.

A seasoned CMO product development team with the right skills, tools, and experience can minimize the need for multiple design iterations, saving time and dollars. Further, if that team also shares its customers’ values, it will be more inclined to consistently commit 100 percent of its energies to delivering the best possible service. An OEM should also choose a CMO whose commitment to continued innovation and growth complements its own plans for the future. If this is the case, the synergy between the two organizations will add value over time and increase the potential for a lasting and productive relationship.

Once a selection has been made, the final piece of advice I would offer an OEM would be to create linkages with their chosen CMO counterparts at all levels of management, beyond just the “supply chain” group. This will ensure the relationship is more than simply a transactional one. If the CMO team feels as though it is respected and is being treated fairly, it will be encouraged to consistently go the extra mile and do everything within its means to guarantee a successful product launch.

Rhoads: It’s so much more than lowest price. The product’s success hinges on every single component including the shipping and quality systems. Look for a CMO that will create a mutual relationship that seeks to make the OEM successful and really gets what it takes to make them successful.

Semcer: When seeking a CMO partner, OEMs should look for a proven track record in the medical device industry, including familiarity with FDA requirements. Ideally, an OEM should look to partner with a financially stable CMO that is not over-leveraged. A viable CMO partner should demonstrate a history of adding technologies and capabilities through organic investment, resulting in a broader offering of proficiencies that, in effect, create “one-stop shopping” for the OEM.

Smigelski: It is important to consider the capabilities of a CMO and ensure their manufacturing processes will help a product meet its performance and cost requirements. Every CMO has a specialty and every product has specific production method requirements; it’s important these two match.

Fenske: What steps must an OEM take in order to evolve from dealing with a CMO purely as a supplier to establishing a true collaborative partnership with that CMO?

Dziedzic: Trust is the foundation for a truly collaborative partnership. When the OEM trusts the CMO enough to openly discuss their strategy and challenges, the CMO can complement the OEM’s technology roadmap and deliver targeted solutions that improve outcomes and lower costs. The relationship continues to flourish as the CMO honors that trust and consistently delivers predictable, reliable results.

Flaherty: The “promised land” for medical device OEMs is to shift from a transactional relationship to a strategic partnership with a CMO. In this scenario, the CMO has a deep understanding of the OEM’s strategic direction and can align its investments to support the customer’s long-term objectives. The reality is that the more strategic relationship requires both

companies to openly share information, which can be challenging for both sides.

Ragaller: OEMs should engage the CMOs in conversations focused on the broad definition of value. Agree on the key elements of the CMO’s value proposition and the most important metrics that measure performance against those attributes. Move beyond a P.O. by P.O. relationship defined only by “purchase price variance” to a model focused on measuring and valuing how effective the CMO is in helping achieve the OEM’s goals. Treat the CMO like an extension of the OEM’s organization. Share information early and openly so that the CMO can plan ahead and meet critical milestones. When requirements or anticipated demand changes (as it almost always does), let the CMO know as soon as possible. Surprises may be okay at birthday parties, but not so much in an OEM/CMO relationship.

Rataul: The goal should be a relationship that is a “win-win” for both organizations. An OEM can begin by establishing objectives that will have a positive impact on the CMO’s bottom line, as well as on its own. The OEM should be candid and forthcoming, sharing what it needs to be successful in the marketplace and asking the CMO how it can help. A financial incentive can be offered that rewards the CMO for its value-add. Finally, to build a truly collaborative, long-lasting partnership, executive-level contacts within both organizations should be established and nurtured over time.

Semcer: OEMs should seek to involve the CMO as early as possible in the design phase in order to allow the CMO to bring its expertise to bear on a project through prototyping and design for manufacturability. Establishing clear requirements and transparency in communication is critical for both parties. Treat the CMO as an extension of the OEM and build trust that there will be a sharing of both risk and reward for every project the partnership undertakes.

Smigelski: Consulting with your CMO partner during the product development process is key to developing effective and manufacturable products. Beginning your relationship with a CMO after design freeze but well in advance of manufacturing readiness is key to successful and timely manufacturing transitions.

Weijers: Establish a true partnership. Understand that both sides have to create win/win scenarios to be able to succeed. For example, some OEMs ask for pricing discounts without any justified ways to provide cost downs. It takes both the OEM and CMO to work together and identify cost reduction opportunities.

Fenske: Conversely, what does a CMO need to do to illustrate to an OEM that it is capable of being a collaborative partner in a medical device project?

Rataul: A CMO must be able to demonstrate a customer-focused culture. Knowing that its success depends on the success of its customer, a quality CMO will adopt a supportive posture that says to the OEM “We have your back.” A CMO can demonstrate this attitude by taking the initiative to propose ways to bring value to the project—even without the customer having to ask for input. For example, an experienced CMO can suggest supply chain changes that will lower costs, design solutions that will lead to greater IP opportunities, or recommend process improvements that will reduce time to market. The more complex a project, the more chances there are to collaborate in a productive manner.

Semcer: CMOs should work toward transparency in all communication with an OEM. A disciplined project management process with proactive communication is a necessity. Flexibility and the ability to react quickly to changes in a project are also crucial. In short, it is important to demonstrate the same accessibility, honesty, and dedication that an outstanding internal department would offer. Be a team member, not a supplier.

Smigelski: A strong CMO partner needs to demonstrate a deep understanding of the manufacturing process and how that may affect product performance and safety. Additionally, a good CMO partner will have a deep understanding of what products fit their capabilities.

Weijers: Provide excellent project management skills with a cross-functional support team to ensure a higher success rate of meeting project timelines.

Fenske: As some OEMs seek to shrink the number of suppliers with which they are working, what attributes should they value most in the CMOs they are looking to retain?

Dziedzic: In addition to the selection criteria mentioned previously, OEMs should also value a CMO’s breadth of capabilities, financial resources, vertical integration capabilities, supplier-based innovation, technical subject matter expert know-how, innovative processes, and global footprint.

Flaherty: OEMs are looking for a supplier that can meet a wide range of needs and accommodate growth as a product matures. But breadth of capabilities is not enough—to bring maximum value, a CMO also has to offer deep technical expertise in the OEM’s market. CMOs that have developed successful working relationships with their OEM customers will also have an advantage, and are well-positioned for the shift from a transactional relationship to a strategic partnership.

I also think it’s important for OEMs to partner with a CMO that specializes in the healthcare market. It builds confidence to know that the CMO has deep expertise in the products and services you’re focused on, and that they’ve made a commitment to investing in the industry. If a CMO is spread thin across multiple industries, they simply can’t provide the specialized level of expertise you get from a CMO that’s focused and deep. With OEMs looking for fewer, stronger partners, that’s what a CMO needs to make the cut.

Rataul: An OEM’s short list of preferred CMOs should include those that are a good match in terms of size, those that are nimble and able to adapt, and those that are continually working to expand their capabilities. Most importantly, OEMs should choose to partner with CMOs that have a long and proven track record of stability and of successfully delivering on their promises.

Rhoads: Trust! Trust is a combination of competency and results. Does the CMO have the competency to give them what they want through the technologies, the experience, the quality system, the staff and facilities, etc., and are they giving reliable results?

Semcer: When selecting a CMO to partner with, OEMs should consider those that are financially stable, willing to invest in innovative technology and expand capacity, and who have a proven track record of building world-class relationships across every level of the organization.

Weijers: Demonstrate success within their own expertise and know-how. Operational excellence and quality are a given.

Fenske: With quality being of paramount importance to medical device OEMs, in what ways are CMOs ensuring they meet the necessary standards put forth by their customers?

Dziedzic: When considering the CMO’s quality standards, make sure there is data-driven, risk-based decision making in all facets of the product lifecycle. Ask if there is a strong sub-supplier management system that ensures the entire supply chain for the OEM is sound and meeting cascaded quality requirements. And, of course, make sure the CMO maintains required governmental certifications and registrations. In the end, it comes down to successfully extending a culture of quality from the OEM to the whole of the CMO. When this happens, high quality outcomes follow.

Rhoads: We have to start by really understanding our customers’ needs and expectations. Often, this is beyond just what’s on the drawing. It goes deeper into how the product will be handled when it’s received, the sterility and packaging requirements, the documents that the customer’s quality group will receive and how they receive it are all part of the quality expectations. We’ve also been doing more with data collection systems that enable us to show evidence to our customers and allow our customers to take our parts direct from dock to stock with confidence.

Semcer: With advent of ISO 13485:2015, a CMO must incorporate risk-based thinking into all aspects of their business, including consistent training of employees across all levels of the organization to further build expertise.

Weijers: CMOs should extensively use risk management tools (FMEA, Fault tree analysis, etc.) throughout the supply chain and internal manufacturing processes.

Fenske: Is M&A activity among OEMs having an impact on the CMO? If so, what is the impact?

Dziedzic: Absolutely. M&A activity often results in an OEM doing business in non-core markets. CMOs can fill gaps in the OEM’s broadened portfolios with turnkey solutions for non-core products, which allows the OEMs to focus on their core product areas.

Flaherty: Medical device OEMs that are in the process of integrating recent acquisitions create Venn diagrams of all their suppliers, and in some cases, the overlap is really small. They see a lot of opportunities for consolidation. Those OEMs are really scrutinizing their supply chains. The suppliers that offer breadth of services, technical know-how, and the ability to scale as the product matures will rise to the top.

Ragaller: We’ve witnessed over the past decade an enormous consolidation in the medical device industry. OEMs almost always identify supply chain synergies as part of their strategy for creating value from an acquisition. One way they capture those savings is through rationalizing and reducing their list of approved suppliers. CMOs who tout themselves as a “one-stop-shop” need to have more than a limited set of capabilities and capacity. OEMs want partners who can satisfy a wide variety of needs, which requires capital and scale. Small, narrowly-focused CMOs will find it increasingly difficult to compete for business with the large OEMs unless they have a unique, differentiated offering.

Rataul: Perhaps, the biggest impact is that the makeup of the team on the OEM side might change, along with its responsibilities. The OEM can find itself working with a CMO that it did not choose, has no experience with, and therefore, may not value. The worst situation for a CMO that has invested heavily in an acquired company is that the acquiring company might have an outsourcing strategy that does not include it. To safeguard its investment, the CMO might reasonably start asking for volume commitments to be included in any service contract.

Rhoads: The impact has been mostly positive for us. If we start working for a smaller company and that product line gets bought, we’re the approved supplier of the product line. We now become an approved supplier for a new customer with a larger presence in the marketplace.

Weijers: Sure thing. Cultural changes and leadership changes are the number one cause for partnership success and failures.

Fenske: Conversely, is M&A activity within the supply chain impacting OEMs? If so, what is the impact?

Flaherty: After an acquisition, there’s always some potential for a CMO to get distracted. A strong CMO will be able to manage through disruptions. If they’re going about it right, part of the due diligence process is evaluating the complexity of the integration in terms of risk, which will affect how attractive a target is. If a CMO is acquiring the “right” company—a target that fits well into their strategic vision—it will ultimately reinforce their market strengths. By picking the right targets, you can strengthen the value to the customer and minimize disruptions.

Ragaller: As the CMO market consolidates, OEMs will benefit as their supply base becomes smaller, yet more capability-rich. All parties in this new, streamlined value chain have a stake in making the entire system more efficient and responsive. CMOs and OEMs who understand that this is not a zero-sum game with winners and losers, but instead an opportunity for both parties to gain from an improved, collaborative model will lead the industry going forward.

Semcer: M&A activity within the supply chain can impact OEMs. For example, some roll-ups can become over-leveraged, leading to financial concern. Some may be awkwardly “bolted together” and the “parts” may not work well together. Ultimately, in order to justify the massive investments, some may have a desire to move upstream into the realm of the OEMs themselves, offering branded products of their own.

Fenske: Given the current political environment, are OEMs altering their view of offshore outsourcing vs. domestic outsourcing? Has there been any notable change in this type of activity?

Rataul: We have not noticed a change as of yet. However, if tangible alterations are made to rules affecting trade, such as the addition of new tariffs, I believe OEMs will be prompted to rethink their manufacturing strategies.

Rhoads: I think there has been a shift even before the current political environment. A decade ago, we would see more pressure, especially in injected molded parts. More recently, I think OEMs have recognized the negative impacts of sourcing from overseas and the costs and delays of shipping as well as intellectual property challenges versus the responsiveness and controls in place with domestic sourcing. We strive to build a solid relationship with our customers and being geographically located in the Northeast Corridor has greatly helped us to do so.

Smigelski: It doesn’t appear that they are. There are significant cost advantages, in some cases, when using offshore partners, but the type of products offshore partners are effective at manufacturing is limited to certain product types and levels of quality. Domestic manufacturers are still often superior at manufacturing medium- to high-complexity products.

Weijers: Not really. In my experience, OEMs still look for the best total cost of ownership and will make their outsourcing decision based on this important factor that drives their overall satisfaction with CMOs.

Fenske: In what ways will the OEM/CMO relationship change in the medical device design and manufacturing space in the next five to 10 years? Design and manufacturing space in the next five to 10 years?

Dziedzic: Over the next five years, we expect to see ongoing initiatives to improve patient outcomes. Healthcare economics will continue to be a factor leading to price pressure on OEMs, which will drive strategic outsourcing of development and manufacturing activities. We also anticipate further consolidation with OEMs, leading to the need for full-service, large-scale CMOs. This could cause further CMO consolidations.

Over the next 10 years, we expect to see the shift to more data, services, and new business models. The focus will be less on hardware and more on what’s around that hardware. This provides opportunities for CMOs that specialize in building these full systems to align with the OEM.

Smigelski: It appears that many CMOs are moving deeper into the product development space. They will need a better understanding of effective R&D practices and augmented teams to deliver the innovation most OEMs need.

Weijers: Most medical device markets are only growing 4 to 6 percent annually. Ongoing cost pressures will drive OEMs to find more cost-efficient solutions to support customers. At the same time, OEMs can’t afford to cut on their sales expenses such as local reps that serve customers daily. OEM investments in manufacturing will minimize investments in technology and accessing new growing markets such as India and China. Therefore, OEMs will look to CMOs to provide manufacturing solutions that reduce operational expenses.

Fenske: Do you have any additional comments you’d like to share regarding the OEM/CMO relationship in the medical device design and manufacturing space?

Dziedzic: Technology innovation is critical to success as established markets mature and new markets emerge. By partnering, OEMs and CMOs can solve medical challenges that enhance the lives of patients they serve. Integer takes pride in its rich history of collaboration with OEMs. From the first implantable pacemaker and implantable batteries to the future of miniaturization and combination catheter and guidewire products, Integer will continue to partner with the leading medical device companies to shape the future of healthcare.