An examination of the transformation within orthopedic material selection from traditional metals to newer alternatives.

By Mark Crawford, Contributing Writer

Dean Entrekin contributed his expertise to this article and is a Technical Solutions Director of orthopedics at Viant.

This article originally appeared in ODT (Orthopedic Design & Technology).

Material properties are foundational for medical devices to achieve effective clinical outcomes. Decades ago, orthopedics almost exclusively focused on metal. Over the last 10 years, material options have shifted toward polymer-based components, including polymer/metal hybrids and disposable polymer instruments.

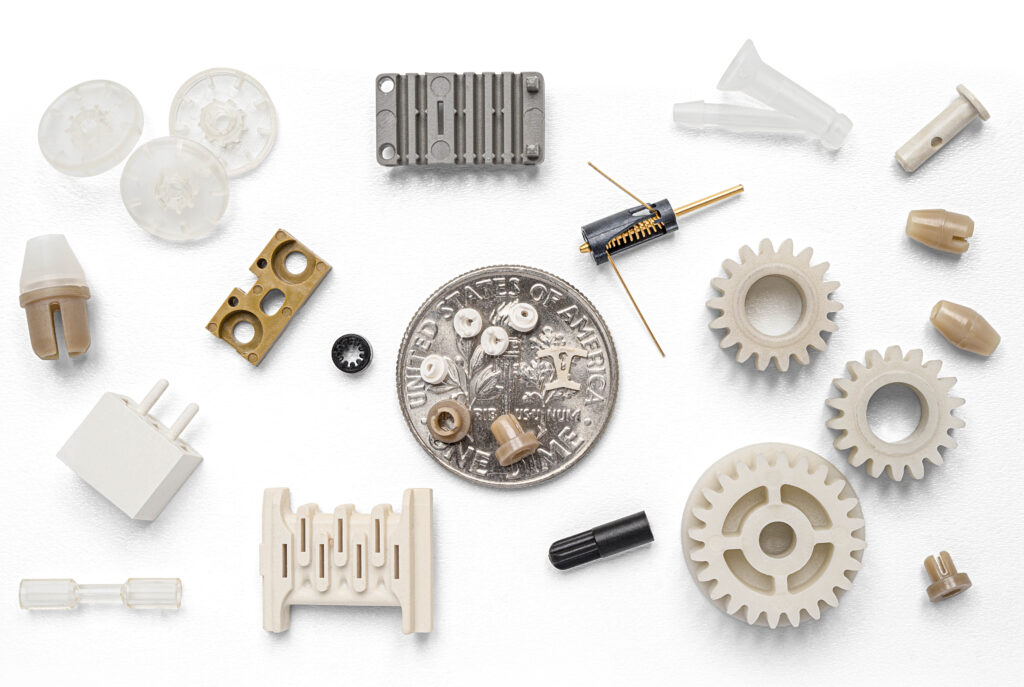

Material science continues to rapidly evolve to meet the needs of disruptive new technologies such as additive manufacturing and 3D printing. Advanced injection molding can handle a wider range of polymers for key product applications. New or enhanced materials provide engineers with more options for creative medical device designs, higher functionality, and improved patient outcomes. Digital patient care and embedded electronics are also driving innovation in medical materials.

Despite these exciting advances, however, orthopedic OEMs tend to remain very conservative when it comes to choosing materials for their implants and instrumentation. Adoption of new materials tends to only happen when a new design requires some level of functionality that incumbent materials simply cannot offer. Given the effort, risk, and cost involved with validating new materials, designers generally only consider materials that enable “need-to-have” rather than “nice-to-have” product features.

More recently, this resistance is starting to fade. OEMs must embrace new materials to stay on the cutting edge of technology and remain competitive. As demand increases for smaller, more complex, and more functional devices with highly specific engineered material properties, medical device manufacturers (MDMs) must keep up with material science. Products made with advanced materials help meet end-user demands for improved patient benefits, product safety, and cost controls. Other considerations for material selection are biocompatibility, resistance to sterilization/decontamination, longevity of mechanical properties, and color variation for color coding.

Materials commonly used in orthopedic products include metals and metal alloys, biostable plastics, bioabsorbable polymers, biocomposite polymers/ceramics, bioceramics, collagen, and extracellular matrices. With all these options to consider, and new materials with highly specific properties being announced on a regular basis, MDMs rely heavily on their contract manufacturers (CMs) and material providers for the up-to-date knowledge and expertise they need to make informed decisions about materials.

Matching the right material to the right device to the right procedures is a key element in the product development and commercialization process. “Ultimately, the best device solutions come when manufacturers and materials suppliers work hand in hand with one another to create product and process efficiency,” said Bing J. Carbone, president of Modern Plastics, a Shelton, Conn.-based provider of high-performance plastics.

What OEMs Want

OEMs want to make devices that deliver better and more reliable outcomes. They are intensely focused on driving down costs however they can, which often involves material-related strategies. Using cost-effective materials that exhibit the precise properties required for the application is critical for success. Materials impact both performance and cost through their ease of use (design for manufacturability), durability, longevity, and regulatory acceptance.

One material strategy for cost control is using standardized materials whenever possible. This is particularly true for instrumentation. For example, Solvay Specialty Polymers, an Alpharetta, Ga.-based provider of high-quality polymers for a variety of manufacturing industries, is seeing growth in its standard medical color palettes for key products. “Customers are increasingly choosing finished, pre-colored materials, rather than seeking to custom-color natural resins on their own,” said Dane Waund, global marketing manager for Solvay Specialty Polymers. “This simplifies their supply and regulatory efforts considerably.”

OEMs are intent on improving clinical outcomes by using materials that work more naturally within the body, such as biocomposite materials for soft tissue fixation devices. Stronger biocomposite materials are being developed to overcome challenges with device failure in hard bone; faster resorbing materials allow for more predictable absorption and bone remodeling.

This new focus has created a shift away from metal and plastic permanent implants to products manufactured from materials such as biocomposites, bioceramics, and collagen that promote or facilitate the biologic basis of healing and bone/soft tissue remodeling. “The goal is to create implants that not only provide a very strong structural repair, but over a period of time absorb into the body and go away after the healing has taken place,” said Kevin Cooney, director of product marketing for DSM Biomedical, an Exton, Pa.-based global solutions provider in biomedical science and regenerative medicine. “Long term, the patient is left with strong underlying native tissue with no implant left behind. This really is where medicine is going, and our goal is to be at the forefront of these innovations.”

Enhanced device functionality and performance, such as improved part strength, chemical and sterilization resistance, and lighter weight, are also high on the OEM wish list. Products must be made from materials that can withstand repeated autoclaving cycles (reusable) or gamma sterilization (implantable) without major deformation or loss of mechanical properties.

With the FDA’s increased scrutiny of the supply chain, MDMs want to be certain their CMs can keep up with their quality demands. More MDMs want access to master file information because it speeds up time to market and reduces costs in proving material compatibility to regulators. “Products must be safe for the patient and the supply chain,” said Carbone. “The regulatory environment has become more stringent and is making the device manufacturers responsible for the safety of the products offered. ISO 10993 is offering testing standards that will match the requirements of regulatory agencies such as FDA or CE marking.”

MDMs typically do not have the resources to vertically integrate by developing advanced biomaterials on their own and therefore will occasionally partner with material suppliers to develop a specific device. Sometimes OEMs (especially smaller startups) ask material suppliers to help them engineer custom materials with highly specific physical characteristics, typically done by modifying existing materials. This may involve working directly with suppliers to procure raw material in a very specific range within the overall chemistry range for that material.

Material Advances

The number of different plastics approved for long-term human implants is still fairly limited, as are the suppliers for these materials. Among other medical grade polymeric materials, the most common acetal copolymer, Celcon M25 (trademarked material from Celanese), is being discontinued in July 2019. A new resin known as Hostaform MT is being introduced as an improved formulation. This particular plastic is widely used in a number of applications for surgical devices and instrumentation, where short-term duration of less than 24 hours of patient contact is applicable. “A material developed by Westlake Plastics from heat-stabilized polypropylene is a good alternative to acetal copolymer, and this particular polymer is more stable, has higher chemical resistance, weighs less, and has a much better price point,” stated Michael Kell, business development manager for the life sciences division at Total Plastics International, a Fort Wayne, Ind.-based provider of medical grade thermoplastics. “Original equipment manufacturers should take a good look at this from all aspects as a viable alternative.”

In the realm of ultra-high-performance polymers, both polyetheretherketone (PEEK) and ultra-high molecular weight polyethylene (UHMWPE) continue to show improved functionality and performance. For UHMWPE, “additives along with some new processing changes, some of which are proprietary, are intended to further improve and extend the life of this material in a patient,” Kell added. “Other materials for implants continue to evolve, and we have seen softer materials such as silicone and polyurethane take their place in the medical device market.”

Hybrid PEEK materials are designed to make PEEK, which is normally an inert material that does not promote tissue or bone growth, more biologically active. For example, “titanium-coated PEEK has been widely accepted for surgical implants because it provides the strength and radiolucence of a polymer, with the surface texture and bone apposition of a titanium implant, without the stress shielding radiodensity,” said Dean Entrekin, director of technical solutions for orthopedics for Viant, a Foxborough, Mass.-based provider of medical device solutions.

Improved variations of PEEK continue to enter the market. In November 2017, Solvay Specialty Polymers introduced a 30 percent carbon fiber-reinforced radiolucent polymer for implantable devices that is twice as strong as unmodified PEEK, making it attractive for structural, load-bearing implantable devices in spine, hip, and knee replacements. This new polymer is also inherently radiolucent, giving it an advantage over metals, which prohibit visualization of implants and fusions using various medical imaging methods. In July 2018, the FDA granted approval to Vallum Corporation to market a PEEK spinal interbody fusion device with a unique nanotextured surface, which is the first FDA-cleared nanotextured surface on a PEEK interbody device. The 20-50-nanometer indentations that comprise the texture are created by blasting argon atoms across the PEEK microsurface.

DiFusion Technologies, an Austin, Texas-based provider of advanced biomaterials, has created a hybrid PEEK material that dramatically enhances osteoconduction, according to early studies. Zeolite molecules added to Solvay’s Zeniva ZA-500 PEEK polymer changes the material to a negatively charged substance that supports osteoconduction, while preserving the polymer’s visualization, modulus, and strength characteristics. “We can also load strontium, magnesium, and zinc into the same matrix and control how much is eluted,” said company president and CEO Derrick Johns. “We think that introducing other ions in this platform down the road is going to be the future of tissue regeneration.”

Further, in 2006, Solvay acquired Mississippi Polymer Technologies, which had developed a new polymer chemistry called “self-reinforcing polyphenylene,” or SRP, which offers exceptional strength, stiffness, and hardness without fillers or reinforcements. “We are convinced this technology has possible applications within orthopedics, particularly those that require higher modulus and strength than PEEK can offer,” said Waund. “We may relaunch the chemistry sometime soon.”

Nitinol is a popular shape memory nickel-titanium metal alloy that is 10 times more flexible than ordinary metal. It offers the flexibility of bone with the strength of metal, making it a good choice for plates and other applications where stress shielding would be negative. “Nitinol’s memory characteristics make it ideal for implants,” said Entrekin. “It can be pre-shaped and then, when exposed to body temperature, assumes its previous shape to provide closure. For example, a nitinol staple can be applied to both sides of a fracture and pull the fracture closed.”

Adding platinum to nitinol can improve the radiopacity of those materials. Other recent advances focus on its wear resistance. Research has recently shown that magnetoelectropolishing can improve the fatigue resistance of a nitinol part—which can be especially beneficial for delicate nitinol wires. Engineers at Fort Wayne Metals, a Fort Wayne, Ind.-based materials manufacturer, have developed a mechanical conditioning process that, when applied to 0.18-mm super-elastic nitinol wire, results in a 20 percent gain in high-cycle fatigue performance and a 50 percent gain in low-cycle fatigue performance. Post-processing via this conditioning process can be applied to wire diameters ranging from 20 microns up to 1 mm in most binary alloys. Also, because of the extreme thermal sensitivity of nitinol’s microstructure and thermomechanical performance, low-temperature femtosecond laser machining of nitinol is ideal for cutting fine features with no heat damage, improving the product’s durability. Nitinol can also be 3D printed. Scientists at Eindhoven University of Technology in the Netherlands have released a proof-of-concept study for the successful 3D printing of self-expanding, biodegradable nitinol stents.

Demand for bioabsorbable materials is on the rise, including metals. “Both magnesium and zinc alloys are being developed in the cardiovascular market, typically for stents,” said Entrekin. “They can perform their functions, then dissolve over time, and the by-products are not toxic to the body. This allows the body to recover naturally. Companies are thinking about how this technology can be leveraged in the orthopedics space.”

Biostable thermoplastic polyurethanes (TPUs) are now being considered as promising materials to augment or replace bearing surfaces in knee joint preservation and adult joint reconstruction, and are being used in motion preservation devices in the spine, such as disc replacement implants. New additives and advanced processing changes are improving the performance features of UHMWPE, “which improves the life of this material in a patient,” stated Kell. Traditionally, UHMWPE is white in color; recently, DSM Biomedical has developed new colors to aid visual differentiation of multiple suture strands during arthroscopic and open procedures, which helps surgeons overcome some of the challenges of suture management, especially in sports medicine procedures. The company has also developed radiopaque fibers to help visualize positioning using X-ray and osteoconductive options that promote osteointegration, “especially with ‘all suture’ anchors for soft tissue repair and reconstruction,” said Cooney. “Innovative uses of this material will lend to better patient outcomes.”

Because most standard engineering polymers are not visible to fluoroscopy and X-ray radiation, they must be modified so they can be distinguished from tissue and bone under these conditions and provide surgeons with clear visibility. Selection of the appropriate filler and loading is based upon clinical requirements, component size, and location within the body. Popular additives used to enhance the radiopacity of medical polymers are barium sulfate, bismuth subcarbonate, bismuth trioxide, and bismuth oxychloride. These additives make products radio opaque and appear much darker on X-ray and fluoroscopy compared to surrounding tissue, allowing surgeons to properly position devices and instruments with greater accuracy.

Other Trends and Technologies

Orthopedics has been an early adopter of 3D printing technology, especially for implant products. Most additive manufacturing advances are related to metal materials, although an increasing number of orthopedic plastics are coming to the forefront. “For example,” said Waund, “we’ve helped print plastic parts using fused filament fabrication, where we have introduced three new healthcare-specific products this year. We’re also validating product performance with key OEMs using our materials for selective laser sintering.”

Fused filament fabrication is a 3D printing process that, instead of layers of powder, uses a continuous filament of molten plastic to build the product. The plastic filament is dispersed from a large coil through a moving, heated printer extruder head in precise fashion. The layer of filament is laid down on top of or adjacent to the previous layer, and the layers are then fused by heat and/or adhesion.

As implantable medical devices get smaller in size, the need for innovative handling techniques becomes critical. Modifying existing processing equipment, such as molding machines and material dryers, to facilitate the handling of low quantities of material during processing is increasingly required. “Shot weights for some of the micro scale parts are such that you need only a pound of material to produce parts for more than 24 hours, when the smallest dryer available in the industry is of the capacity of two pounds,” said Raghu Vadlamudi, chief research and technology director for Donatelle, a New Brighton, Minn.-based provider of engineering, prototyping, and manufacturing services. “The use of these dryers can create performance issues because of the longer dryer times. We keep looking for alternate ways of keeping moisture out of materials.”

Innovative materials are also replacing metal to enable disposable instrument kits. For example, in the spine market, smaller companies have come forward with kits using a glass-filled crylonitrile butadiene styrene material to create lighter instruments that are disposable and less costly. “The material is strong enough to do all the necessary functions, but surgeons so far are reluctant to accept it,” said Entrekin. “Surgeons will pick up the instrument and say, ‘this is cheap; it doesn’t feel like it will do what I need it to do.’ But mechanical tests prove that these instruments are just as capable. We have test data showing that some of the single-use instruments we’ve recently developed have outperformed their predicate devices.”

“Current conventional wisdom views anything associated with plastic or single-use as bad for the environment,” added Waund. “However, multiple studies indicate that the CO2 footprint of single-use instruments is comparable and potentially even lower than that of reusable instrumentation.”

Materials for the Future

Much more material research and development is occurring in university laboratories across the country, compared to efforts by OEMs and suppliers. Therefore, MDM engineers and designers are limited to the products and materials that are accepted by the FDA. Breakthrough material advances happening in academia are at least 10 to 15 years away from commercialization because manufacturability is an issue, or safety and effectiveness have not been proven through long-term studies. Therefore, OEMs are often limited to looking at materials used in other markets—for example, cardiovascular or general surgery—to leverage properties such as apposition to bone or antimicrobial surfaces for orthopedic implants.

Some material providers are now offering bovine-free materials and issuing certificates attesting to the environmental sustainability of the vegetable-derived sources for their materials. “This is the case with Trinseo and implantable surface modifiers backed by a Kosher certificate of compliance,” said Jackie Anim, principal material engineer at Ethicon, a Cincinnati, Ohio-based provider of medical devices, in a recent article in Plastics Today.1 “Other potential benefits on the horizon include the development of composites with impregnated variable resistance and temperature-sensing capabilities.”

Breakthroughs in medical materials today are just the tip of the iceberg of what is coming, especially as 3D and 4D printing drive innovation, she noted. The field of smart polymers, for example, has huge potential. “Uninvestigated technologies such as oxygen-detection materials for touch screens, lubricants that can be reactivated after multiple autoclave cycles, and autoclave-resistant lubricants and coatings need attention,” added Anim. “Printable pharmaceuticals and swallowables that perform diagnostics and transfer data to remote devices are also an untapped and unmet need.”

Reference

This article originally appeared in ODT (Orthopedic Design & Technology).