By Sean Fenske

This article originally appeared in Medical Product Outsourcing Magazine

Twenty years ago, outsourcing wasn’t spoken of very much. Original equipment manufacturers (OEMs) didn’t want to admit they used third-party companies to aid in manufacturing tasks. They certainly didn’t want to admit they were using products and/or components developed overseas. It was the worst kept secret in the industry, sure, but it didn’t change the fact that many were using service providers to enhance their own capabilities. Fast-forward a few years and outsourcing was an acceptable business practice, but it was primarily reserved for manufacturing. The OEMs handled everything else.

Move forward a few more years and several more tasks were being taken on by the OEMs’ service providers, such as packaging, sterilization, and warehousing/distribution. Continue to follow the pathway and design, engineering, and regulatory tasks are moving to outside companies. Today, even more responsibilities are being assigned to these companies, leaving OEMs to focus on true core competencies such as ideation and sales and marketing. (Of course, for some, even those tasks are being outsourced.)

Outsourcing’s history in medtech is an interesting tale that continues to evolve. The relationship between OEMs and contract manufacturing organizations (CMOs) similarly continues to transform, most recently moving from transactional arrangements to a more collaborative partnership. Also, many OEMs are working with one-stop-shop organizations who offer a breadth of services—soup to nuts—including design, prototyping, component manufacturing, assembly, packaging, sterilization, and distribution, along with regulatory aid in product submissions to FDA, supply chain management, and field servicing.

With the increased dependence on CMOs, medical device OEMs are also becoming more demanding of their manufacturing partners. These firms are primarily seeking faster times to market for their products at decreased costs. This arrangement can create ongoing challenges for the CMOs serving the industry. Further complicating the mix, non-traditional firms such as Apple, Google, and Samsung are getting involved in the development of medical technologies (which could ultimately become new opportunities for experienced CMOs), creating anxiety among medical device firms who could face disruption of their market segments.

New policy initiatives such as value-based healthcare threaten to further shrink the market opportunities for device makers. It may not be long before “me too” products are not well-received by the market if they are unable to truly differentiate themselves from competitors. At the same time, value-based care offers great financial incentives for companies to break the cycle of incremental innovation that has been so ingrained into the industry. Products that save physicians time and money in a value-based system will likely gain adoption more rapidly.

With all of this happening in the medical device industry today, the relationship between OEM and CMO has perhaps never been more intriguing or more demanding. Communication and trust are paramount, but ensuring these are properly balanced within the partnership recipe is incredibly difficult.

In order to gain insight and best practices, MPO reached out to a number of representatives from full-service outsourcing firms who are addressing many of these issues every day. They have agreed to candidly share their perspectives on a number of critical concerns impacting OEMs and CMOs as well as this dynamic relationship.

Included in this roundtable discussion are:

Robert Austring is the CEO of Lighthouse Imaging, a Windham, Maine-based end-to-end provider of optical design and manufacturing solutions for global medical OEMs, covering areas such as endoscopic imaging systems, robotic imaging systems, and endoscope metrology equipment.

Georges A. Belanger is charged with new business development for Industrias Plasticas Medicas (IPM). The manufacturer of disposable medical devices for human and veterinarian purposes is located in Cuautla Ayala, Mexico, and also offers OEM solutions, including custom-made products and specialized services for companies in the medical and pharmaceutical industries.

Michael D. Huiras is vice president of sales and marketing for Flexan. With headquarters in Lincolnshire, Ill., the global contract manufacturer specializes in custom, high-precision silicone, rubber, and thermoplastic components and devices. (Note: Huiras would like to acknowledge Jon Wacks, Flexan’s vice president of quality, for his contributions to his responses.)

Matt Jordan is the CEO of Centerpiece, a Solana Beach, Calif.-based outsourcing services firm that offers a full breadth of capabilities from design and development to manufacturing to sterilization and finished device distribution.

Brian King is the CEO of Viant, headquartered in Foxborough, Mass. The firm is a full-service contract manufacturing supplier that offers capabilities from design and development through to finished device manufacturing and assembly.

Charlie Mason is the senior vice president of the Medical Market Segment at Sanmina, a San Jose, Calif.-headquartered global contract manufacturing firm. Sanmina’s medical division offers services from design and engineering through to manufacturing, as well as assistance with quality and regulatory challenges.

Julie Schulte is president of Meraqi Medical, a medical device design, development and manufacturing services company focused on bioelectronics, interventional, and minimally invasive surgical technologies. The Fremont, Calif.-based firm offers services from early brainstorming, concept generation, and prototyping to clinical and commercial manufacturing.

Brian Stern is the director of sales and marketing at Excel Medical Products Inc., a Wixom, Mich.-based contract manufacturer that specializes in precision medical device manufacturing.

Raghu Vadlamudi is the chief research and technology director at New Brighton, Minn.-based Donatelle. The firm is a full service contract manufacturer specializing in complex applications for device sectors including cardiovascular, diagnostics, drug delivery, neuromodulation, orthopedics, and more.

Bill Welch is the chief technology officer at Phillips-Medisize, a Molex company. The global firm is an end-to-end provider of innovation, development, and manufacturing solutions for pharmaceutical, diagnostics, and medical device companies.

Sean Fenske: How would you describe the relationship between the OEM (the brand name device manufacturer) and CMO (contract manufacturing organization) in the medtech industry today and how has this dynamic changed from just a few years ago?

Georges A. Belanger: Now more than ever before, it is common for the OEM and CMO to work together in finding mutual business opportunities. While NDAs are still a regular part of business, the market is finding a new dynamism with more startups and quicker product development cycles.

Michael D. Huiras: There have been a few market events that accelerated the pace and breadth of OEM-CMO relationships. The medical device space has experienced significant consolidation over the last few years. OEMs have narrowed their strategic focus on core competencies, innovation, and global market expansion. Navigating through the always changing regulatory environment, increased pressure to achieve development timelines, and the incorporation of new technologies that differentiate and provide clinical and economic benefit are now the priorities. In parallel, CMOs realized that to stay competitive, they need to invest in innovation, talent, and infrastructure so they can provide fast and economic solutions across the supply chain. CMOs must identify OEMs who are growing and doing so in the right markets since it is the OEM who controls the point of consumption. Lastly, there is increased scrutiny on the CMO to understand and operate in a global regulatory and quality environment like their OEM partner.

Brian King: From my tenure on the OEM side, I’ve seen that OEMs are experiencing more complexities and challenges related to the quality and regulatory environment, market development, product development, and healthcare reimbursement dynamics. They’ve had to focus their resources more on these areas. Manufacturing medical devices has increasingly shifted to the CMOs, which can offer speed and agility that most OEMs just don’t have. In the last decade, the need for more vertical integration has sprouted within CMOs as OEMs look for strategic partners with scale, sophistication, and global reach.

Charlie Mason: OEMs rely more heavily on CMOs now than they did a few years ago and the relationships are becoming much more interdependent. Today, OEMs see CMOs as an extension of their organization. In some cases, CMO employees are co-located at OEM organizations and vice versa. There are also examples of CMOs providing OEMs with direct access to their manufacturing execution systems (MES) and OEMs providing CMOs with access to their design portals.

Julie Schulte: The relationship is very positive and has grown even more so over the years. Among the reasons for the positive growth in the relationship are more experience working together and an increased understanding of each party, how we can bring value to each other, and how working together results in better achievement of objectives.

Raghu Vadlamudi: The answer to this question depends on the types of products and services that are in the mix. In the past, when the technology was not as sophisticated and very few CMOs were in the market, the relationship was based on trust and dependability. Over time, with the advancements in product technologies and also the consolidation at the device manufacturer level, it became transaction based. The device manufacturer is looking to consolidate their supplier base to reduce their cost of goods sold and the marketplace is becoming more global.

Fenske: What factors are driving OEMs to seek out the use of CMOs more today than in the past?

Belanger: A faster speed in product development and a greater number of products in the pipeline suggest a greater demand for specialized services.

Huiras: First, OEM consolidation—reduced manufacturing footprint, lowering overhead. Second, technology—functional expertise is no longer internal for certain manufacturing processes. CMOs are investing in innovation to provide better solutions. Third, CMOs help accelerate projects by leveraging infrastructure and know-how. And fourth, CMOs understand the quality and regulatory environment.

King: Medical device OEMs are facing increasing cost pressure. Those trends are pushing investment toward product development, marketing, and regulatory affairs. In some cases, manufacturing is no longer core to their business. There are better solutions out there with larger outsource partners whose forte is addressing speed to market, cost, and quality.

Mason: There are many factors driving OEMs to expand their relationships with CMOs. Regulatory requirements have become more stringent and FDA audits have become more frequent for OEMs and CMOs outside of the U.S. and Europe. As a result, there is more communication these days between the OEM, CMO, and FDA during audits. Larger OEMs are broadening product portfolios through acquisition. Often, the acquired company is not outsourcing to a CMO, and the OEM introduces the outsourcing model to them. Smaller OEMs tend to be more focused on product development and may not have the range of manufacturing, regulatory, or supply chain capabilities that some CMOs have. Also, as more OEMs have adopted the contract manufacturing model over the past 10 to 15 years, less supply chain management professionals have direct, in-house manufacturing experience and depend heavily on the expertise of CMOs.

Schulte: Factors driving OEMs to CMOs are cost, speed to market, flexibility, capabilities, and capacity.

Vadlamudi: Faster time to market, expertise in manufacturing competencies, and finding skilled talent are significant factors.

Bill Welch: Increased focus on R&D, product IP, and market-facing activity are core competencies of the OEM. Leveraging a CMO and its infrastructure and operations allows for greater focus and funding of the aforementioned competencies.

Fenske: What types of tasks or projects are OEMs employing CMOs to accomplish today that weren’t being outsourced in the past?

Belanger: Mold making of special injection molds and tooling, as well as prototyping and small lot production for market testing.

Huiras: CMOs that were exclusively component manufacturing are being asked to participate in early-stage design, human factor testing, and “up the food chain” activities, including assembly, packaging, and labeling/UDI. OEMs are also asking CMOs to manage the subsupplier supply chain (as opposed to receiving approved materials per the OEM Approved Supplier List).

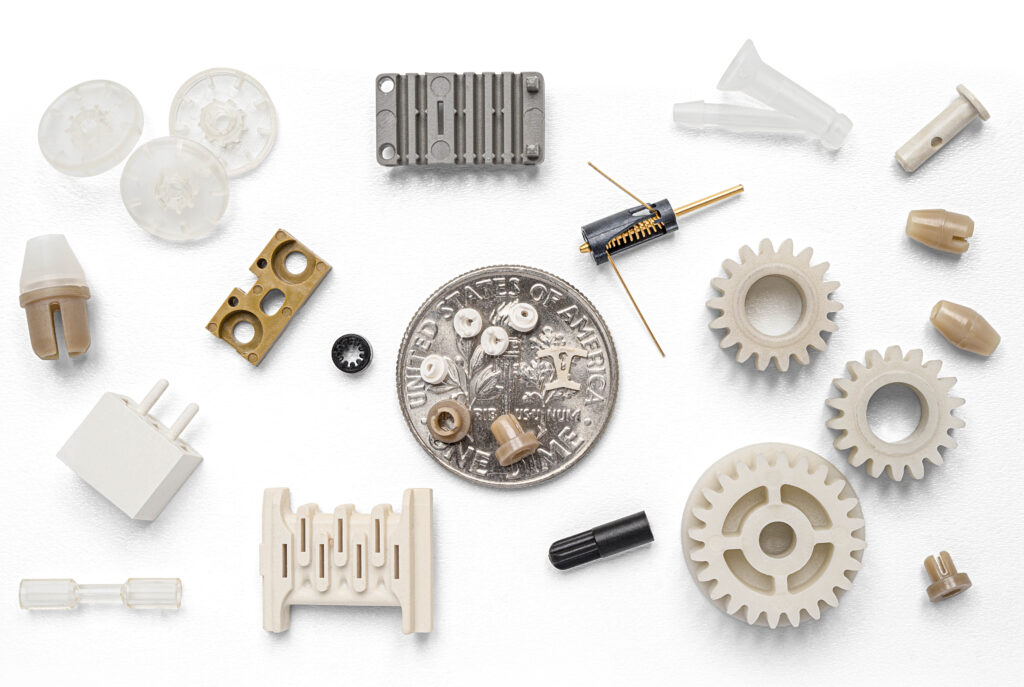

King: We see customers increasingly looking for a vertically integrated partner that can help them simplify and de-risk their supply chain through end-to-end services, from design and material expertise through to manufacturing and packaging.

Mason: In addition to leveraging the CMO’s ability to provide engineering, design, supply chain, and manufacturing services, some forward-thinking OEMs are maximizing the benefits of the outsourcing model by having CMOs manage aftermarket services.

When the CMO is asked to provide both manufacturing and aftermarket services, knowledge gained during the production and test process can be applied to the failure analysis and repair process and vice versa. This retains product knowledge in one organization, providing an opportunity to improve both manufacturing and aftermarket services.

Schulte: Today, we see much more challenging and difficult projects being accomplished by CMOs. In the past, the use of CMOs was primarily driven by getting access to low-labor costs. While that is still a factor today, specialized technical skills and capabilities have also become very important in optimizing innovation for many devices for OEMs. CMOs are uniquely positioned to draw on a diverse set of experiences in certain areas of competence, which can be very effective when developing more challenging design and manufacturing solutions.

Vadlamudi: Some tasks include medical device components (machined, molded), sub-assemblies, along with finished medical devices. Additionally, design work is now often outsourced.

Fenske: What criteria should an OEM use to determine what aspects of product development and manufacture should be outsourced? In other words, how does an OEM determine what to “make vs. buy”?

Belanger: It will all depend on an OEM’s in-house capabilities and core strengths.

Huiras: Cost is only one factor associated with the make/buy decision. Core competency of the CMO is critical to the success/failure of an outsourced project. Equally critical is the status of the product under consideration. Where is this in the product lifecycle? How robust is the product design, design history file, and process validation? If the product requires significant “tribal knowledge” of key personnel within the OEM, is this the best product to outsource to a CMO?

Matt Jordan: For tier two and three medical device companies, defined as the smaller-sized innovators and visionaries, technical expertise and time-related efficiencies dictate that early-stage product development, or a significant portion of it, should likely be outsourced.

In any case, product design centers are typically located in innovative locales that cannot sustain manufacturing operations cost effectively. When ready for manufacturing (prototype or steady state), production operations should certainly be outsourced.

For most tier one OEMs, defined as the top 100 medical device companies, the make vs. buy decision is most commonly and most simply cost-based.

Mason: OEMs must understand their own core competencies, assess where they need help, and determine the strengths of each CMO. For example, manufacturing handheld glucose monitors at a rate of 10 million devices per year requires a different expertise when compared to manufacturing an MRI scanner or an immunoassay analyzer, which requires the integration of multiple complex technologies such as motion, optics, fluidics, and electronics.

From a design perspective, an OEM may need a design partner to take their initial prototype, industrialize it, and develop a product that can be efficiently manufactured. In other cases, they may need a design partner that can solve technical challenges or provide access to advanced expertise such as RF and optical technology. Other OEMs take advantage of a CMO’s global footprint, and the tariff, customs duty, and supply chain advantages this footprint offers.

Schulte: Critical factors are capability, capacity, and time-to-market. For the large OEMs and the startup companies, CMOs offer advantages in all three areas.

Vadlamudi: OEMs should consider a CMO’s expertise in manufacturing competencies and knowledge in device manufacturing practices. Volumes, life of product cycle, and complexity of a part are also attributes that drive OEMs to outsource. With a tight labor market, they may not be able to find the right talent to bring the project in-house.

Fenske: How is creativity and innovation in device development enhanced through the use of a CMO?

Belanger: A CMO is very capable in its own strengths and has a quick time-to-market response.

Huiras: The CMO has the vantage point of working with multiple customers and partners, enabling the CMO to propose solutions the OEM may not have considered. For example, given a CMO’s expertise in molding or assembly, multiple components may be integrated into a single component for significant cost savings. In addition, if the CMO has captive facilities in low-cost manufacturing locations, alternatives to expensive automation or high-cost labor can often be provided to the OEM, which may also bring the advantage of speed-to-market.

King: Creativity plays a role in all phases of a project, not just design. Engineers are regularly faced with the challenge of meeting targets for quality and cost. That’s where creativity comes in. They have to think outside the box, which can lead to developing an innovative solution that can be incorporated into the design and/or the manufacturing process.

Many CMOs have invested in both process and materials innovation. OEMs now have the ability to incorporate directly into their designs to meet customer and product requirements. This value proposition enables more innovation and improved patient outcomes.

For example, we recently helped a customer maximize a major product launch by developing a first-of-its-kind hybrid metal/polymer orthopedic instrument set that was both lighter and easier to use. By improving the surgeon experience, these instruments actually drove implant sales.

Mason: Access to technology from different industries strengthens innovation during device development. For example, most devices are connected. And, more and more medical devices have embedded optics within them. Others require access to microelectronics development for smaller form factors or specific functionality. Choosing a CMO with RF, optical, and microelectronics experience is a significant advantage from a technology access and time-to-market perspective.

Recently, we did a significant portion of design work on a sterilization verification system, and by leveraging our optical design expertise, this new product reduces the time required to verify sterilization test results by 60 percent.

Schulte: A CMO often has a broader range of experience in a particular product area to draw from than the OEM, which can be critical in the ideation and feasibility phases of new product development. In addition, the structure of many CMOs (i.e., smaller, flatter organizations) enables a more agile development process, allowing projects to iterate faster and move more quickly through various states of the product development cycle.

Vadlamudi: Some OEMs come to us with a concept and we work with them to finesse an idea and bring it to life. Many times, this is done utilizing prototyping and 3D printing as it saves time and money to determine what will work in design development. In using prototyping, a product can be produced in hours vs. weeks.

Fenske: In terms of time to market, how can working with a CMO improve upon a project’s schedule?

Robert Austring: From day one, Lighthouse Imaging is designing for manufacturability from concept. There’s a heavy emphasis on the planning phase to define the product requirements, product strategy around the regulatory side of the business, and cost. There is a very focused effort on what the product is and the strategy to bring it to market. This allows us to then go into the development phase with an effective, efficient process knowing the endgame.

By working with an experienced CMO from the onset of a project, and not just from when a product is “deemed ready,” clients can cut down the commercial viability timeline, sometimes in half.

This ability to add experience to the early-stage planning and strategy really positions clients to be most successful in meeting their end goals. Specifically, in the early periods of planning, it is crucial to define objectives, outline deliverables, and discuss measurable results. By deeply understanding the client’s end goals, the product developer can attack the project and produce the best outcomes for time to market. When a product development partner has experience in the different areas of design and manufacturing, an industry focus, and a thorough understanding of the client’s end goals, they are optimally positioning their partner for success.

Belanger: The CMO already has the knowhow and infrastructure in place to work quickly at its core competencies.

Huiras: Regardless of company size, OEM engineering resources are often strained given the project load in-house. They are focused on development milestones and the CMO is an extension of their team and can focus on their project. A CMO can often provide both design/engineering support in addition to the traditional manufacturing transfer activities. Assuming the selected CMO has the required core competency (e.g., molding, printed circuit board assembly, automated packaging, etc.), the OEM can provide the expertise to rapidly move the project faster than scarce internal resources.

King: Working with a CMO brings speed and agility. OEMs can get bogged down by their internal infrastructure and breadth of initiatives; whereas a CMO is singularly focused on providing the OEM their products on a consistent basis. OEMs need to partner with a CMO that has the scale and sophistication to move quickly within a highly regulated environment. Partnering with an end-to-end supplier like Viant and working within our quality system can get a product from the design phase through manufacturing quicker. By applying Lean principles throughout the product lifecycle, we can bring our creativity and expertise to ensure that the product is manufacturable and meets or exceeds all requirements, while accelerating time to market.

Mason: An OEM can accelerate time to market by selecting a CMO that has a ready-made supply chain, an ISO 13485-certified design organization with experience designing FDA compliant systems, and a compliant manufacturing infrastructure.

CMO partners with preferred suppliers will be able to accelerate component and supplier selection. Experience in medical design also allows the OEM to access additional resources and key technology to expedite the design schedule. Availability of a well-established manufacturing facility and quality system that has successfully passed FDA audits over many years can improve time to market and increase confidence in regulatory compliance.

Schulte: In most cases, the CMO is offering capacity that is not as readily available at the OEM. Also, in the case of a large OEM, the CMO structure itself can oftentimes allow projects to move more quickly. In the case of startups and early-stage companies, the fact that there is an existing infrastructure in place at the CMO allows a project to hit the ground running much more cost effectively and efficiently.

Vadlamudi: Time savings can be realized by leveraging the experience of a CMO in manufacturing processes. Also, the CMO will have access to cutting-edge technology in manufacturing systems. This is an area where up-front communication, expectations, and early involvement in design and project management becomes critical in delivering a project on time.

Welch: It can provide a more defined scope and focus for the CMO, in what is typically an appropriate but less stringent QMS for components vs. finished devices.

Fenske: Do CMOs offer advantages to OEMs in addressing needs for a value-based healthcare system? If so, what are they?

Belanger: Cost advantages and quicker time-to-market response.

Huiras: Cost containment in the healthcare industry remains a table stake. Through innovation and continuous process improvement, the right CMO can provide an attractive low-cost solution. Coupling this with a robust and proven QMS prevents costs from being introduced into the supply chain.

Mason: This is a very important topic today. More and more OEMs are launching products now with connected or wireless technology, so compliance or system use can be tracked by a healthcare provider or insurance company. One example where we’ve helped customers with these products is in developing automated RF test solutions that minimize the cost of verifying the proper operation of this feature over global cellular networks. Our ability to establish low-cost production and test systems for products that can be particularly price sensitive has value for our OEM customers.

Schulte: Usually, it’s the OEM that looks at how their device fits into the value-based healthcare system. The CMO, however, can provide experience and expertise in optimizing the design from a materials and manufacturabilty standpoint, ultimately optimizing the cost of the device.

Fenske: What other significant advantages are realized by an OEM when working with a CMO?

Belanger: The OEM will avoid an unnecessary learning curve, which can lead to higher costs and time delays.

Huiras: A CMO can literally act as a direct extension of the OEM’s operation, given the right partnership. If both the OEM and CMO have done their homework and invested the required effort in building that

partnership, the OEM has the unique ability to make a significantly lower-risk “make-buy” decision.

King: OEMs can save time, cost, and hassle by working with a CMO that offers depth and breadth of expertise, and vertically integrated capabilities across the full product lifecycle. A CMO should also have the size and scale to meet their needs now, while also investing in innovation to support their future needs.

Mason: Transforming the business model from a fixed cost to a variable cost model is probably the biggest single advantage when choosing to outsource production. Rather than having to invest in facilities, equipment, and inventory, the OEM has the advantage of paying a variable cost for manufacturing when products are required. This can eliminate hundreds of millions of dollars from an OEM’s balance sheet and frees up working capital for new product development.

Schulte: There are many subtle variations from company to company and product to product as to the advantages of working with a CMO, but in the end, the three advantages of capacity, capability, and speed to market usually are the advantages realized by the OEM.

Vadlamudi: OEMs can experience the advantages of one-stop-shop providers, reduced total cost of manufacturing, and the ability to concentrate on what they are good at (i.e., device development rather than process development). Quality and understanding industry regulations are also critical as you want to bring a product to market error-free the first time. Nobody wants to face a recall or have an FDA warning issued; it’s advantageous to partner with the right CMO.

Fenske: What recommendations do you have for OEMs seeking new CMO suppliers? What selection criteria should they consider most important?

Austring: When selecting a partnership with a contract manufacturer, there are three important considerations: selecting the appropriate technology, industry expertise, and compatibility.

Each time a new design begins, oftentimes it is to build upon a platform developed from previous projects with the goal of integrating them or building off of them. The real work comes in linking the projects or generations together in a totally unique or custom fashion innovators have requested. By using solid building blocks, manufacturers can come to a solution quicker than if they were starting from scratch. Innovators bring true intellectual properties or patentable technology to the process and the manufacturers ensure the optimal capabilities. This provides the innovator with a usable intellectual property they can leverage to provide value to their company.

Knowledge and experience with medical devices is necessary when it comes to the development and manufacturing of devices. The design process from proof of concept to manufacturing should be complete with continuous risk assessment and control to make the process as simple as possible.

To take a concept from paper to a commercial device, carrying it through the development process, supporting the customer throughout, and ultimately, manufacturing the product at a targeted cost is essential to success.

Finally, aligning with the correct partner with a compatible philosophy is key. In the design, development, and manufacturing process, the communication and cohesiveness of the OEM and CMO are vital to the success of the project.

Belanger: A one-stop-shop criteria should be considered. The more services a CMO can offer to an OEM, the fewer time delays and adjustments will be required.

Huiras: There are (equally important) technical and business factors to consider, based upon the product under consideration. First, core competency—regardless of how capable a CMO executes, requiring that organization to perform activities not in its wheelhouse can potentially result in disaster. Second, quality is absolute; it needs to be part of the DNA of the organization, system, processes, product, and manufacturing supply. Third, strength of the commercial team/relationship. The best OEM-CMO outcomes are inevitably tied to past business relationships, track record of the CMO management team, and overall knowledge/depth of the CMO medical device space. Finally, fourth is geography (i.e., location of engineering and manufacturing facilities). Although e-mail, Skype, and videoconferencing are all excellent tools to facilitate smooth communication, the value of face-to-face activity cannot be underestimated.

Jordan: First and foremost, find a CMO that has assessed the complete ecosystem of our industry and, subsequently, built an organization around that assessment. That is the type of partner an OEM wants and needs. Centerpiece, for example, is investing substantial capital in solutions considered peripheral to the manufacturing operation, capabilities that begin at the design phase and conclude when sterile finished product arrives at the point of use. We’ve taken the time to listen to and learn what our customers need in a CMO.

Other essential selection criteria/factors include geography and proximity to the OEM, size of the CMO, and demonstrated success with similar devices.

King: What we’ve created at Viant is what I would have wanted in my past OEM leadership positions. A combination of big-company resources—size, scale, sophistication—with a small-company feel: an emphasis on personal attention for every customer. OEMs should look for long-term partners who can function as an extension of their team, a true strategic partner rather than simply a transactional supplier. I’d also advise that they look for a well-balanced and respected management team, with deep expertise on both the OEM and CMO side.

Mason: Outsourcing is a strategic business decision. As such, multiple functions should be involved in CMO selection including product design, regulatory management, and service and repair functions, if this work may also be outsourced. The most successful OEMs form cross-functional teams that consider the impact on the full product lifecycle when outsourcing. Medical systems often have longer product lifecycles and require extended engineering support, availability of spares, and maintenance. In this context, selecting a supplier that provides end-to-end services—design through volume manufacturing through to the end of a product’s life—will result in a lower total cost of ownership when compared to choosing a supplier based only on the requirements associated with volume manufacturing.

Schulte: It’s important to capitalize on the subject matter expertise that a CMO can provide. Relevant experience in the key technical areas required by the device can save several iterations and allow you to get novel solutions faster. Additionally, assessment of the chemistry for a successful working relationship as well as a shared passion for the work we do and affecting patient outcomes are critical as well.

Brian Stern: OEMs should begin their search for a CMO supplier by considering the capability requirements for their project, and seeking out CMOs that meet most, if not all, of those requirements. OEMs must also consider the production capacity and average lead times offered by prospective CMOs, especially when time to market is critical. The location(s) of CMO facilities is also rather important when it comes to supply chain logistics and transportation costs. Obviously, pricing is going to play a large role in any supply chain decision, but the scope and maturity of the quality system of potential CMOs cannot be overlooked.

Vadlamudi: Ideally, you want a CMO who understands the industry regulations and has a solid focus on what types of materials will work, especially for Class III devices. In looking for a new CMO supplier, be sure to ask the right questions up-front around their controlled processes, audits, ISO certification, and customer experiences.

Fenske: What steps must an OEM take in order to evolve from dealing with a CMO purely as a supplier to establishing a true collaborative partnership with that CMO?

Belanger: Proper intellectual property protection is the first step. Also, assigning special personnel between both companies to be in constant contact is a very important aspect for good collaboration.

Huiras: Establishing strong professional relationships at all functions within each organization (e.g., commercial, technical, operations/logistics, etc.) is the most critical requirement in establishing a true collaborative partnership. Documenting clear project expectations up-front (cost, timeline, responsibilities, etc.) is also crucial in avoiding confusion, delay, or critical deadlines. Costs are always a sensitive subject. However, establishing trust and the mutual understanding of the drivers of costs only help the relationship over time. There is huge opportunity for education/understanding with CMOs without compromising proprietary information. Above all else, plan, plan, plan!

Jordan: A true collaborative partnership requires a transparent relationship between companies, with active executive participation and involvement. Executives from both the OEM and CMO should attend quarterly business reviews and meetings of significance. In addition, joint and/or mixed teams should work together to reduce costs, championed by the director-level and above. Finally, the OEM and CMO should collectively celebrate the wins. All too often, the successful projects, programs, and people are overlooked.

Mason: The OEM and CMO must collaborate at both a working and a senior management level, and plan for genuine interdependence to become embedded in the DNA of both organizations. Forming a cross-functional team with members drawn from both the OEM and the CMO is essential. The team should have shared goals, regular face-to-face meetings, and periodic reviews with joint executive sponsors from both companies. Co-locating one or more employees from the CMO with OEM employees and vice-versa will help.

Schulte: The OEM should do its homework as it would for approaching any potential long-term relationship. After making a decision, it should work with the CMO in much the same way it would its own staff. The OEM needs to see the relationship as being one that needs attention, mutual respect, and transparency. Further, good communication and collaboration need to be fostered for both parties to grow successfully toward execution of the common goals.

Vadlamudi: Relationship building is an important part of establishing a partnership. OEMs need to fully understand the capabilities the CMO can provide. We find that sometimes OEMs see us as being really good at one area of our business, but don’t always identify us for some of the other projects they may have available. In understanding their full capabilities, they can alleviate using multiple suppliers, making project management easier with fewer suppliers to manage.

Fenske: Conversely, what does a CMO need to do to illustrate to an OEM that it is capable of being a collaborative partner in a medical device project?

Belanger: A robust quality system is very important, as well as vertical integration of the processes required to produce the product.

Huiras: Track record is the best indicator for future success. Elements that a CMO should illustrate include technical competency/expertise, depth/experience of the management team, ability to manage a project of similar magnitude/complexity, and required quality system and regulatory/compliance expertise.

King: CMOs have to cultivate a relationship of mutual trust, nurtured by great service and commitment to being good stewards of customers’ resources. CMOs must develop what we call “servant leadership,” which focuses on serving others—including customers, employees, end users, and patients. At Viant, we’re building a culture of relentlessly upholding our customers’ reputations for delivering high-quality, high-value devices. By acting in your customer’s best interest, you both win.

Schulte: The CMO needs to show experience, commitment, and a willingness to both listen and offer constructive suggestions and alternatives. It needs to be responsive and flexibile so it can pivot with the customer. It also needs to show a shared passion for achieving successful outcomes.

Vadlamudi: A collaborative CMO offers a one-stop-shop for Design for Manufacturability (DFM), with a wide variety of manufacturing processes employed, along with a proven track record and comprehensive understanding of medical device industry regulations.

Fenske: As some OEMs seek to shrink the number of suppliers with which they are working, what attributes should they value most in the CMOs they are looking to retain?

Belanger: Past experience in working with the CMO should demonstrate commitment to the project with on-time deliveries and, of course, product quality.

Huiras: CMO integrity and transparency are the most important values an OEM should investigate. Questions an OEM should value include, “Can the CMO effectively work in an open, honest, and frank relationship?” “Can the CMO demonstrate how they have learned from previous mistakes?” and “Is continuous improvement merely a slogan, or is it built into the company’s DNA?”

Jordan: OEMs attempting to shrink the supply base commonly search throughout their existing portfolio of legacy suppliers first, which is unfortunately a collection of mom and pop shops that have, or have not yet, been acquired by larger companies. OEMs hope to find a do-it-all existing supplier. Rather, OEMs must be willing to find new partners that have diverse value chain capabilities and the financial backing to execute and scale. Add one, reduce six.

King: We believe that OEMs are looking for the scale, size, and global resources of larger companies, with industry expertise and the personal attention and service of a smaller company. That’s the “sweet spot” that Viant strives to achieve.

Mason: OEMs need to think in terms of end-to-end product lifecycle management and vertical integration when reducing the number of supplier partners. Choosing a supplier that can provide design, prototype, NPI, supply chain design, volume manufacturing, and aftermarket services will yield significant benefits. The OEM does not need to select suppliers for each stage of the product’s life. The knowledge transfer happens once, and the CMO retains the product knowledge for the lifetime of the product.

Selecting a supplier with vertically integrated manufacturing capabilities will deliver additional benefits. For example, a CMO that can manufacture enclosures, machined components, PCBs, backplanes, cable systems, PCBAs, and complex systems can streamline the supply chain considerably. The OEM will not need to manage all of these individual commodities. Even when the OEM chooses to select third parties to supply some of these components or sub-assemblies, having a CMO with deep technical expertise in these areas can be a significant advantage when technical problems arise.

Schulte: They should value past experience and the important role the right CMO can play in advancing their new product introductions. There is risk in shrinking your CMO partnerships too much. Having the flexibility to bring on new, nimble partners is always a good option to have so that you ensure you have the right partner at the right stage of the process. Further down the development path, you want to ensure your partner is mature enough to support you successfully as you scale and be committed to a long-term parternship.

Stern: Successful contract manufacturing relationships develop through a consistent history of producing high-quality products on time, and within budget. However, there are a number of intangible features of truly successful and lasting contract manufacturing relationships. The most important of these are flexibility, attention to detail, and communication. Priorities and deadlines can change at the drop of a hat, so it is very important that a CMO is flexible and adaptive to deliver according to evolving OEM preferences. In order to consistently maintain the highest standards of medical device quality, it is crucial that details are not overlooked, no matter how small. A CMO should spend the time to refine procedures and thoroughly train production staff to ensure standards are met and efficiencies (and therefore cost savings) can be realized.

Finally, open, accurate, and responsive communication throughout the product lifecycle can save time and money, and help to build the trust required for a successful and lasting contract manufacturing relationship.

Vadlamudi: OEMs should value a CMO’s ability to deliver quality product on time with minimal disruptions supported by sound quality management systems in place. It is also important to evaluate how the CMO will be developing the manufacturing processes (whether by trial and error or by using scientific manufacturing practices).

Welch: Global footprint and scale, with a QMS that matches the risk profile of the products or components sourced to the CMO.

Fenske: With quality being of paramount importance to medical device OEMs, in what ways are CMOs ensuring they meet the necessary standards put forth by their customers?

Belanger: A team needs to be assigned to each new project, documentation should be completed from the beginning, both companies should agree on a timetable, and quality objectives should be established.

Huiras: A robust contract review performed by the CMO is the most effective way of meeting customer standards and requirements. If the CMO does not clearly understand the expectations, quality is compromised at the very start of the project.

Executing an effective new product introduction process in compliance with global device requirements will also resolve the vast majority of quality concerns. Following a clear, methodical, and robust design control process upfront will prevent lots of tears and anguish when the production machines are turned on.

Jordan: Innovative industry leaders like Centerpiece are embracing automation with the objective of exceeding OEM quality standards. While most connect the concept of automation integration with labor cost savings, automated assembly lines more importantly reduce process variation, increase manufacturing yields, and improve overall quality performance.

Most companies will inevitably move toward a more automated production floor, both domestically and internationally. My advice for OEMs is to start preparing for automated solutions during the product design and DFM phase.

Mason: OEMs are depending on CMOs to have even stronger quality and regulatory controls than they did a few years ago. During inspections and audits, CMOs are more deeply engaged, acting as an agent for the OEM and providing information in real time throughout the process.

At Sanmina, we have implemented a centralized quality process and IT system that is deployed regionally and audited independently to ensure global compliance to standards. When supporting a common customer across different regions, having a unified QMS ensures all sites can share data, optimize results from one site to another, and avoid repeating any previous mistakes. Best practices, audit results, and customer feedback can be shared from this common platform and used to proactively drive improvements across all sites and can even be applied to other customers or industries.

Also, some CMOs are adding automated, custom camera systems that perform critical quality inspections, not only for improved efficiency but also to ensure reliability and consistency. Instead of depending on an operator to manually inspect a high volume of products each day, cameras can verify UDI (unique device identifier) and other label content and placement, and perform critical visual and mechanical inspections. At Sanmina, we have some automated lines where over 20 cameras have been implemented to verify the quality of individual processes, with “go, no-go” results based on these automated inspections added to the eDHR.

As automated inspection becomes more widely adopted for system assembly, CMOs are taking tools previously used only for high-volume products, and deploying them on mid-to-lower volume products to drive quality and consistency.

Schulte: Quality is critical in our business and I think there has been an education at all levels within the supply chain; it has to be in the DNA of every single supplier. Many of today’s CMOs mirror the quality and support systems residing at the OEMs, but with more flexibility built into the earlier stages of the product development process.

Vadlamudi: CMOs are employing people with training and expertise in not only the manufacturing processes but also in regulatory practices. CMOs are also offering continued training to employees as industry changes evolve, to ensure their talent is prepared.

Fenske: Is M&A activity among OEMs having an impact on the CMO? If so, what is the impact?

Belanger: We haven´t had any experience with this so far, but I imagine it will all depend upon the OEM for whom the CMO is working and the new objectives established by the companies being merged or acquired.

Huiras: Certainly. This is driving supplier consolidation and is forcing the CMO to invest in new technology and capabilities to maintain the supplier relationship. It is also driving M&A activity within the CMO space.

Mason: Forward-thinking OEMs understand the value a CMO can bring to integrating a new business, standardizing regulatory and compliance processes, and scaling revenue. They actively engage CMOs to help them accelerate M&A completion.

When an OEM acquires a new business or merges with another organization, one of the most challenging aspects can be consolidating different IT systems, infrastructure, and processes. CMOs are accustomed to dealing with many different companies and interfacing with many different IT systems used in design, operations, supply chain management, and order fulfillment. Some CMOs have developed highly accelerated methods to integrate new businesses within the organization, achieving operational efficiencies, improving regulatory compliance, and scaling newly acquired business.

At Sanmina, for example, we are familiar with a range of different design tools for project management, as well as electrical and mechanical design. Our IT systems interface with diverse logistics and MRP systems used by customers for order fulfillment and supply chain management. Sanmina has also developed a centralized IT and regulatory compliance system that is deployed at every site around the world and audited independently, enabling seamless integration of new facilities without interrupting operations.

Schulte: The M&A activity is actually another factor driving the greater use of CMOs. As the major OEMs get larger and larger, they often can’t execute at the speed a CMO can so they outsource more. Additionally, strategic investments in outside companies have been increasing. This is improving the probability that more early-stage companies, who often use CMOs, have a better chance of succeeding and are not bogged down by the buracracy of a large company.

Vadlamudi: The impact is probably more stringent at the OEM level, but CMOs have had to adapt to closed supplier lists. For example, if a CMO were doing business with a smaller OEM that becomes acquired, the parent OEM may have policies in place on which suppliers to use moving forward.

Fenske: Conversely, is M&A activity within the supply chain impacting OEMs? If so, what is the impact?

Huiras: Small to mid-size OEMs might be too small for the large CMOs where smaller opportunities do not fit their business model. CMOs are also in a better position to negotiate price and terms with OEMs but also leverage their raw material supply base. CMOs can also be more selective with whom they partner; OEMs with breakthrough products in growing markets would be a priority focus.

Jordan: The M&A activity is certainly impacting OEMs, but it is too soon to know precisely what the impact is and whether it is positive or negative.

Here is what we do know—M&A is creating bigger, but not necessarily better, CMOs. As Deloitte’s Life Sciences Outlook highlights, “large deals tend to be focused on traditional acquisitions that are within the core competencies of the acquiring business.”

In my opinion, our industry needs a new supplier, or set of suppliers, focused on the “operational value chain”—a truly integrated set of businesses with capabilities starting at product design and concluding with sterile product distribution. All should be connected via one ERP system and harmonized with the same quality system.

The most overused term within the supply chain is “vertical integration.” For example, having a handful of injection molding machines 100 miles from your production facility does not mean you are vertically integrated. It means you acquired a plastics company and rebranded the organization with catchy phrases.

CMOs willing to invest and expand their offering—in alignment with the customer’s needs—will be successful as we move forward. When it comes to M&A, it’s about the quality of acquisitions, not the quantity.

Schulte: As the supply chain consolidates, in the short term, there is a loss of some of the fast responsiveness of smaller suppliers who are bought in. However, over time, new suppliers emerge and evolve to fill that void.

Fenske: Given the current political environment, are OEMs altering their view of offshore outsourcing vs. domestic outsourcing? Has there been any notable change in this type of activity?

Belanger: Our experience has been that we, as a Mexican company, have gained several contracts that were being outsourced to Chinese companies previously (i.e., companies elected to go the route of nearshoring instead of offshoring).

Huiras: It is certainly part of the conversation, but the cost advantages for offshore sourcing are still attractive. If the manufacturing environment is stable, low-cost regions are certainly attractive. Natural disaster events like the Puerto Rico hurricane, however, have caused some concern over risk mitigation. Domestic manufacturing is an option if the ability to automate or the complexity requires a higher skill level to support. Ideally, we like to be in the position to provide a long-term solution for the product lifecycle where, over time, the option of moving manufacturing offshore to drive costs out is attractive.

Jordan: The political left’s push to raise the United States minimum wage has OEM business owners concerned, and rightly so. The average minimum wage in the United States is less than 10 dollars. A wage increase to 15 dollars, even if gradual, is a threat to any business unless it can pass cost increases through to its customers via pricing. OEMs don’t have that option. In fact, they are under a tremendous amount of downward pricing pressure from GPOs, IDNs, and increasing competition in the market. Moreover, an increase to the minimum wage will disrupt the entire pay scale for hourly labor, both direct and indirect. The negative impact to the domestic manufacturing industry will be substantial.

Should the minimum wage increase, OEMs will be forced into two options: avoid the labor cost increase via outsourcing its manufacturing to a low-cost region such as Mexico or China, or quickly implement automated assembly processes and thereby eliminate as much employee headcount as possible.

Mason: Tariff changes have impacted some industries; however, there is significant cost to revalidate a supply chain if medical system production is moved from one location to another. When manufacturing is moved, the new production lines must also be completely revalidated.

The current tariff environment is, however, causing OEMs to conduct a more thorough total landed cost analysis for new products, with the results of these analyses influencing the production location for new products. Also, multinational medical OEMs now design products for certain countries, such as India and China. A CMO may have a medical manufacturing presence in these countries with SEZ (Special Economic Zone) or DTA (Domestic Tariff Area) status, or both.

Schulte: I don’t think so. It would seem offshore outsourcing will continue because there are a host of factors driving the need, and neither domestic nor local will be able to fill all those needs.

Welch: Phillips-Medisize’s approach to global CMO service for its customers is to produce in the primary region of sale as a way to minimize risk and supply chain disruption. “Make in low-cost country (LCC) for sales in the U.S.” isn’t a sustainable business model as wages and standards of living improve in LCCs that have the skills and available talent to produce effectively in the healthcare space.

Fenske: In what ways will the OEM/CMO relationship change in the medical device design and manufacturing space in the next five to 10 years?

Belanger: I believe the relationship will grow exponentially since it´s in the best interests of the OEM to outsource operations to a more experienced supplier with faster results and lower costs.

Huiras: There is no question that a CMO provides an OEM with options to save money, cut time to market, and extend an OEM’s product development and manufacturing reach. The next five to 10 years will result in establishing truly collaborative/cemented OEM/CMO relationships that span all global manufacturing locales and markets served.

Integrating contract design, clinical trials support, and contract manufacturing within a single CMO structure is another exciting possibility to consider in the future.

Jordan: First, we will see CMOs evolve into areas outside of traditional device manufacturing. Patients today are benefiting from ever-increasing access to pharmaceutical drugs and cell therapies. We are thus, accordingly, leveraging our pharmaceutical-based partnership to better position ourselves for the future of device manufacturing. Traditional device CMOs should follow suit by repurposing themselves, investing in new capabilities, and expanding into biotech or manufacturing combination products.

Second, technological solutions will become more and more integrated within the industry. As a result, new systems, processes, and solutions will manage a greater share of the CMO/OEM relationship. For example, within the next 10 years, global sales and operations planning processes will be managed by some form of AI rather than a collection of disconnected people and Excel spreadsheets. The industry will soon rely more on technology-based decision making rather than manual and subjective planning that currently drives the OEM to CMO management process. Furthermore, companies will invest more in innovative technologies like IoT that link manufacturing and visual factories, while simultaneously making real-time data available to its executives and customers.

King: If the relationship develops correctly, CMOs will look and feel like part of the OEM organization. Quality is table stakes (get this wrong and you are out of business). There has to be trust and great service, and we have to move beyond a transactional relationship into a truly strategic partnership.

OEMs are increasingly likely to focus more of their resources on product development, access, reimbursement strategies, and marketing as the speed of innovation continues to accelerate. They will look to move more product design, manufacturing, packaging, and ancillary services toward the outsourcing model, and we believe that will happen quickly. OEMs will be on the lookout for partners with strong reputations who have size and scale, and the ability to take on larger projects utilizing a more intimate customer relationship.

Mason: Larger, more established OEMs will expect CMOs to design the product, establish the supply chain, handle the NPI, and perform product validation and manufacturing. We’ve seen this trend increase over the past 10 years.

OEMs will also involve CMOs during the due diligence stage over the next five to 10 years as they look to acquire other companies. CMO involvement helps them mitigate issues related to product design, regulatory requirements, and manufacturing processes, enhancing the confidence associated with a particular M&A transaction.

Schulte: It will most likely continue to grow as the major OEMs get bigger, and they need more new products brought to the marketplace faster.

Vadlamudi: Technology continues to change how devices are designed and produced; devices are getting smaller. The impact in design, as well as developing the right talent, will be critical in years to come for both OEMs and CMOs. In the end, innovation and technology changes will continue to drive efficiencies, and demand in healthcare will continue to grow as patient populations age and also continue to grow. Industry regulations will also continue to stay ahead of the trends to ensure patient safety and efficacy are priority.

Fenske: Do you have any additional comments you’d like to share regarding the OEM/CMO relationship with in the medical device design and manufacturing space?

Huiras: The best CMO/OEM relationships create competitive advantages for both parties. CMOs are in a fortunate position of being able to help multiple companies achieve their strategic goals, while OEMs are the growth driver for CMOs. When CMOs pick the right OEM partners and support their growth, the CMO’s path to success is much clearer.

Schulte: I think being a CMO in the medical space today is a very cool place to be. We are a critical piece of the innovation cycle in bringing new technologies to market—often partnering closely with OEMs of all sizes on leading-edge devices that save and enhance lives. At Meraqi, we understand all aspects of designing technically challenging devices, as well as serving as a critical component supplier. At the same time, we understand how to be fast, nimble, and innovative in our approaches. We collectively have decades of experience across many device sectors and are subject matter experts in agile product development methods for bringing complex medical devices to market. It is not hard to love what you do in our industry.